Family Office Software Built for Real Complexity

Consolidated reporting across entities, assets, and structures. Built for modern family offices that need control, accuracy, and clarity.

Asset Vantage replaces spreadsheets and stitched tools with one system for:

- Multi-entity accounting

- Real-time consolidation

- Portfolio and wealth reporting

- Audit-ready numbers defensible over time

When Family Office Complexity Grows, Systems Break

Most family offices do not start with broken systems. They break as entities, assets, and structures increase.

Reporting spread across tools

Data lives in multiple systems, forcing manual stitching before every report.

Manual consolidation

Entity-level numbers rely on spreadsheets and repeated reconciliation.

GL and investment data misalignment

Accounting and portfolio views do not reconcile without manual intervention.

Every new entity adds effort

Complexity scales faster than the team can absorb.

Audit stress and rework

Numbers need repeated explanation before they can be trusted.

Delayed decision-making

Insights arrive late because consolidation is never truly finished.

The Cost of Running Family Office Finance on Layered Tools

As complexity increases, stitched workflows create delays, rework, and uncertainty. Real control requires one system, not connected parts.

Layered & Stitched System

Fragmented, delayed, and manual

Multiple systems, multiple truths: Accounting, performance, and reporting live in different tools and never fully align.

Manual reconciliation after every change: Adjustments require repeated fixes across spreadsheets and systems.

Close cycles stretch as complexity grows: Month-end timelines expand with each new entity, structure, or asset class.

Audit and governance risk increases over time: Controls weaken as workflows become harder to trace..

Single Native System

Instant, consistent, and audit-ready

One authoritative data model: One authoritative data model

Native general ledger at the core: Journals, adjustments, and audit trails are built in, not layered on.

Real-time consolidation across entities: Real-time consolidation across entities

Faster, predictable close cycles: Faster, predictable close cycles

Audit-ready by design: Controls, access, and history are always intact and traceable.

The Cost of Running Family Office Finance on Layered Tools

As complexity increases, stitched workflows create delays, rework, and uncertainty. Real control requires one system, not connected parts.

Accounting Is the System of Record

- All reports and performance views are derived directly from accounting entries

- No parallel data models or external summaries exist outside the ledger

Accounting Changes Propagate Everywhere

- A correction made once updates every dependent report automatically

- No manual reconciliation across tools or duplicated fixes

Period Close Retains Integrity

- Closed periods remain stable even when late data arrives

- Adjustments are traceable without rewriting historical results

Reporting Is Derived, Not Assembled

- Reports are generated from the same underlying data model

- Conflicting numbers across views and periods are structurally prevented

A Single Native System for Family Office Finance

Asset Vantage is built as a single native system where accounting, performance, and reporting operate on one authoritative data model.

There is no stitching, syncing, or reconciliation layer. Every change reflects everywhere, instantly.

Multi-Entity

Consolidation

Data Aggregation

& Reconciliation

Integrated

General Ledger

Portfolio

Performance

Multi-Entity Reporting That Holds at Scale

Portfolio systems and wealth platforms treat entities as reporting inputs, not accounting realities. As structures multiply, roll-ups become fragile.

A family office system must roll every entity from the same accounting foundation.

- One reporting logic enforced across all entities and structures

- Roll-ups derived from accounting, not assembled from summaries

- No parallel consolidation logic or shadow spreadsheets

- Numbers that remain consistent as complexity increases

Performance and Accounting on the Same Data

In wealth platforms, performance is calculated outside the accounting system. As adjustments occur, numbers drift and explanations multiply.

A family office system must calculate performance directly from the general ledger.

- Performance derived from accounting entries, not recalculated separately

- Changes reflected automatically after accounting updates

- One explanation that ties every number back to the books

- No competing versions of returns or net worth

" >

" >

Aggregation Without Manual Cleanup

In layered systems, aggregation creates work. Data must be normalized, mapped, and corrected every period.

A family office system must structure data correctly at the source.

- Investment and accounting data aligned by design

- Corrections made once at the accounting layer

- No downstream normalization or validation cycles

- Fewer errors as structures and volume grow

Audit-Ready by Default, Not by Effort

As history changes, audit confidence degrades

Portfolio and reporting platforms rely on processes to become audit-ready.

A family office system must be audit-ready by design.

- Accounting histories preserved across entities and periods

- Controls and permissions enforced at the system level

- Clear traceability without manual reconstruction

- Fewer audit surprises as complexity increases

What a Single Native System Actually Delivers

When accounting, performance, and reporting operate on one data model, finance stops reacting and starts operating with control.

~60% Less Time on Reconciliation

Families report a sharp reduction in reconciliation effort once data no longer needs to be gathered, matched, and revalidated across systems.

Reports in Minutes, Not Days

Standard and ad-hoc reports generate directly from live data, without manual roll-ups, exports, or offline adjustments.

Month-end Closes in Days, not Weeks

Standard and ad-hoc reports generate directly from live data, without manual roll-ups, exports, or offline adjustments.

Live in ~4 Weeks

Entity structures, assets, and reporting come online without rebuilding workflows or reengineering spreadsheets.

Proven at Real Family Office Scale

Used by family offices managing complex entities, structures, and asset classes globally.

on Platform

Customer Presence

on Platform

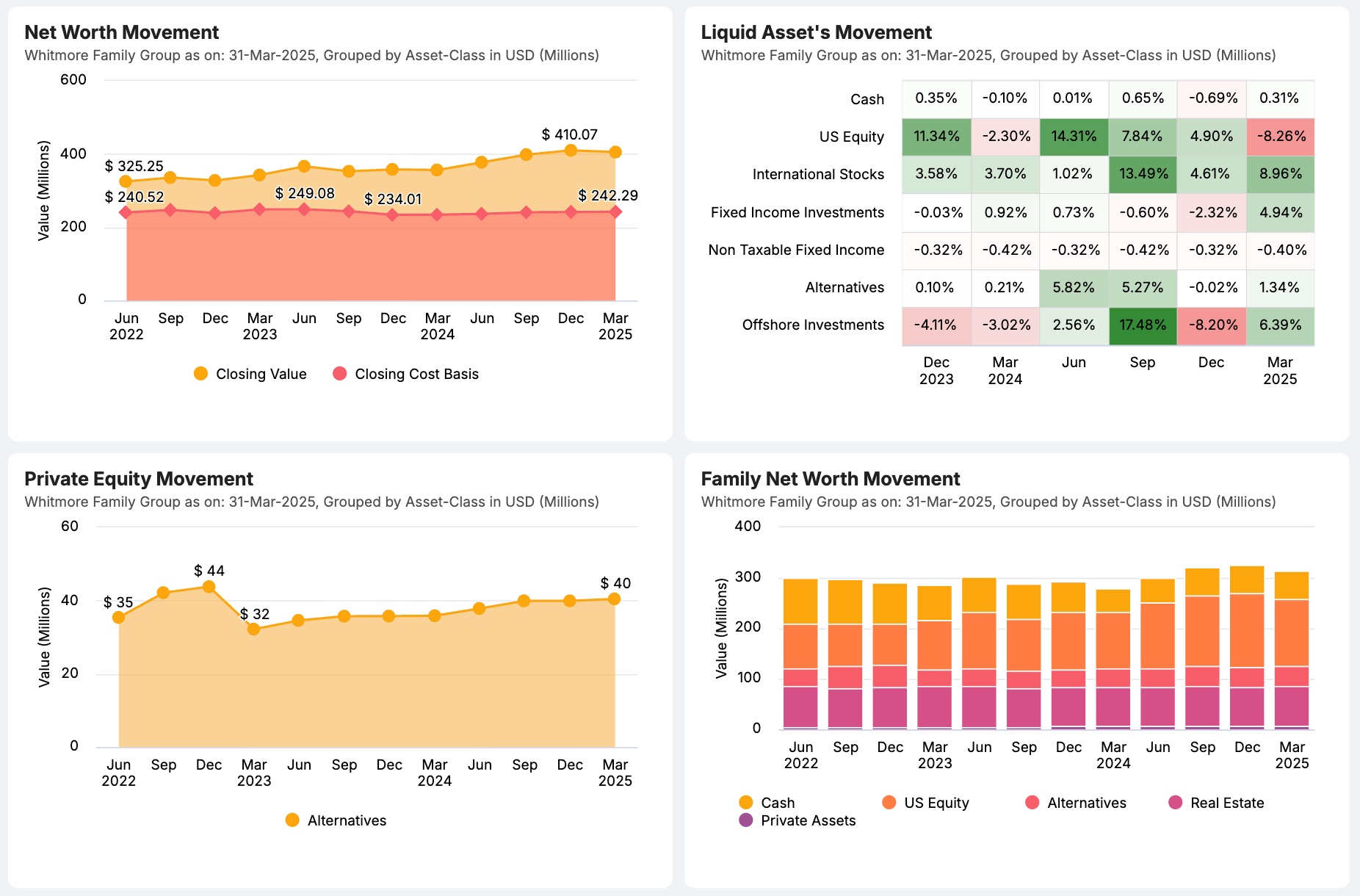

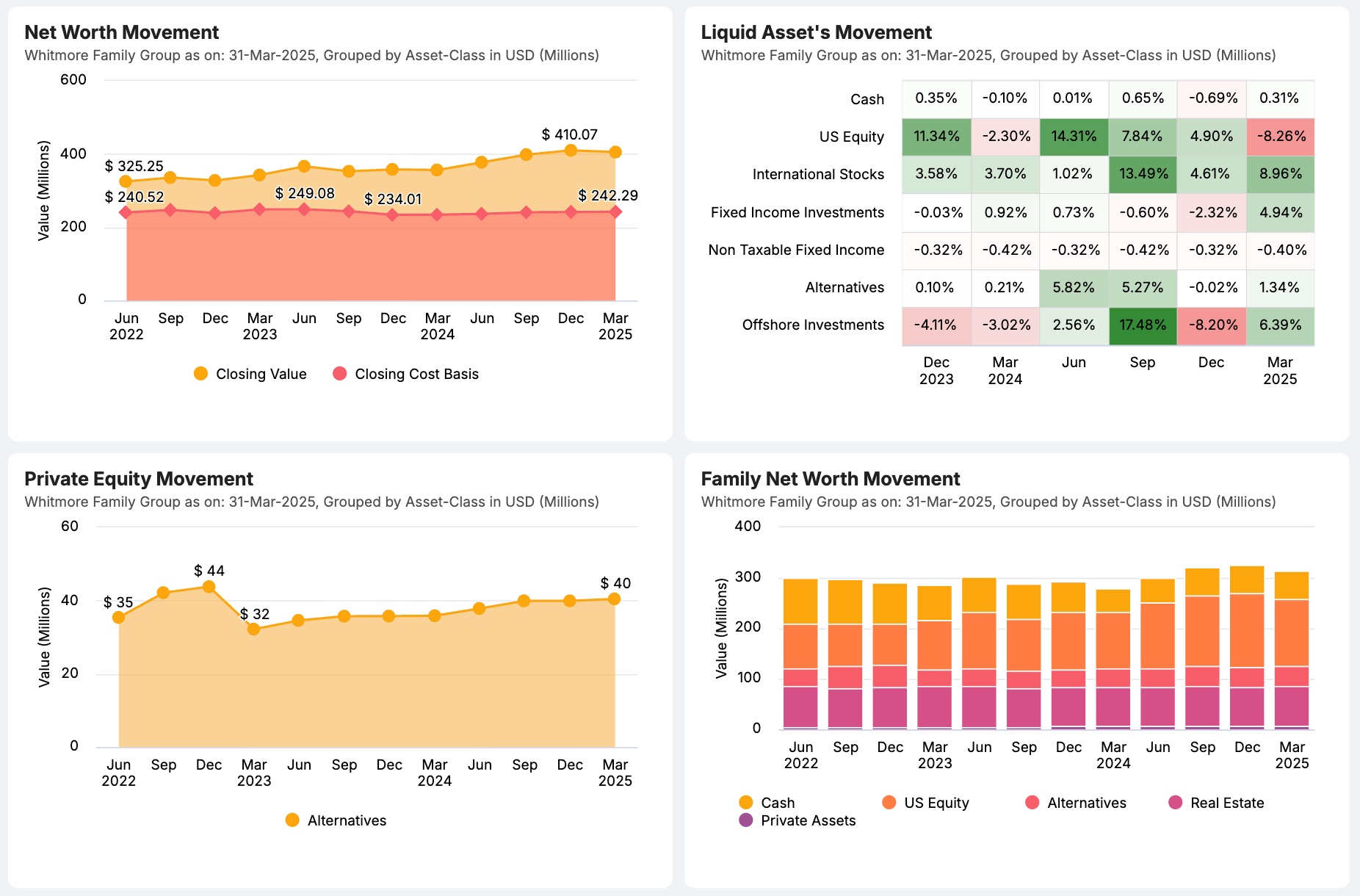

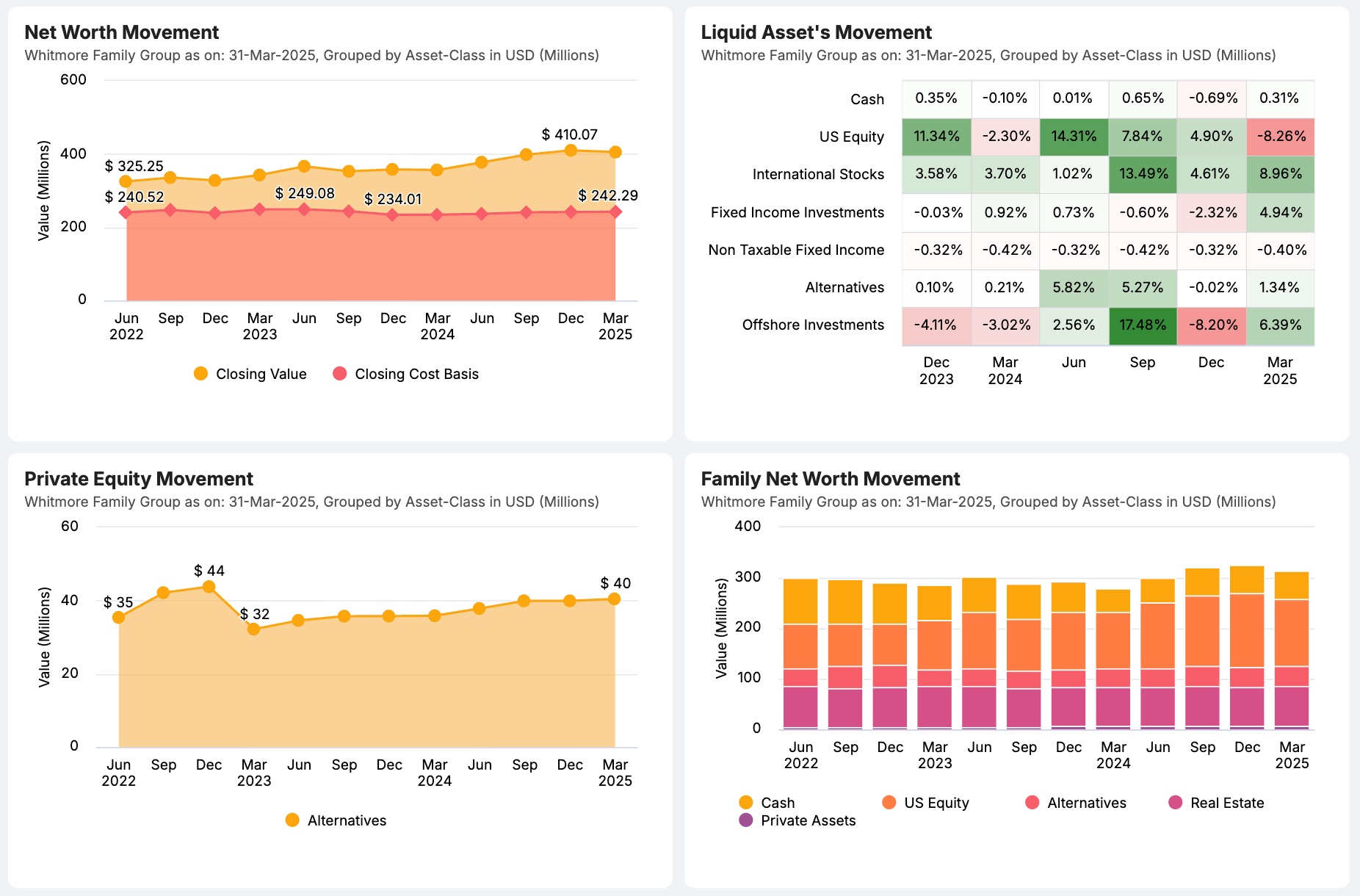

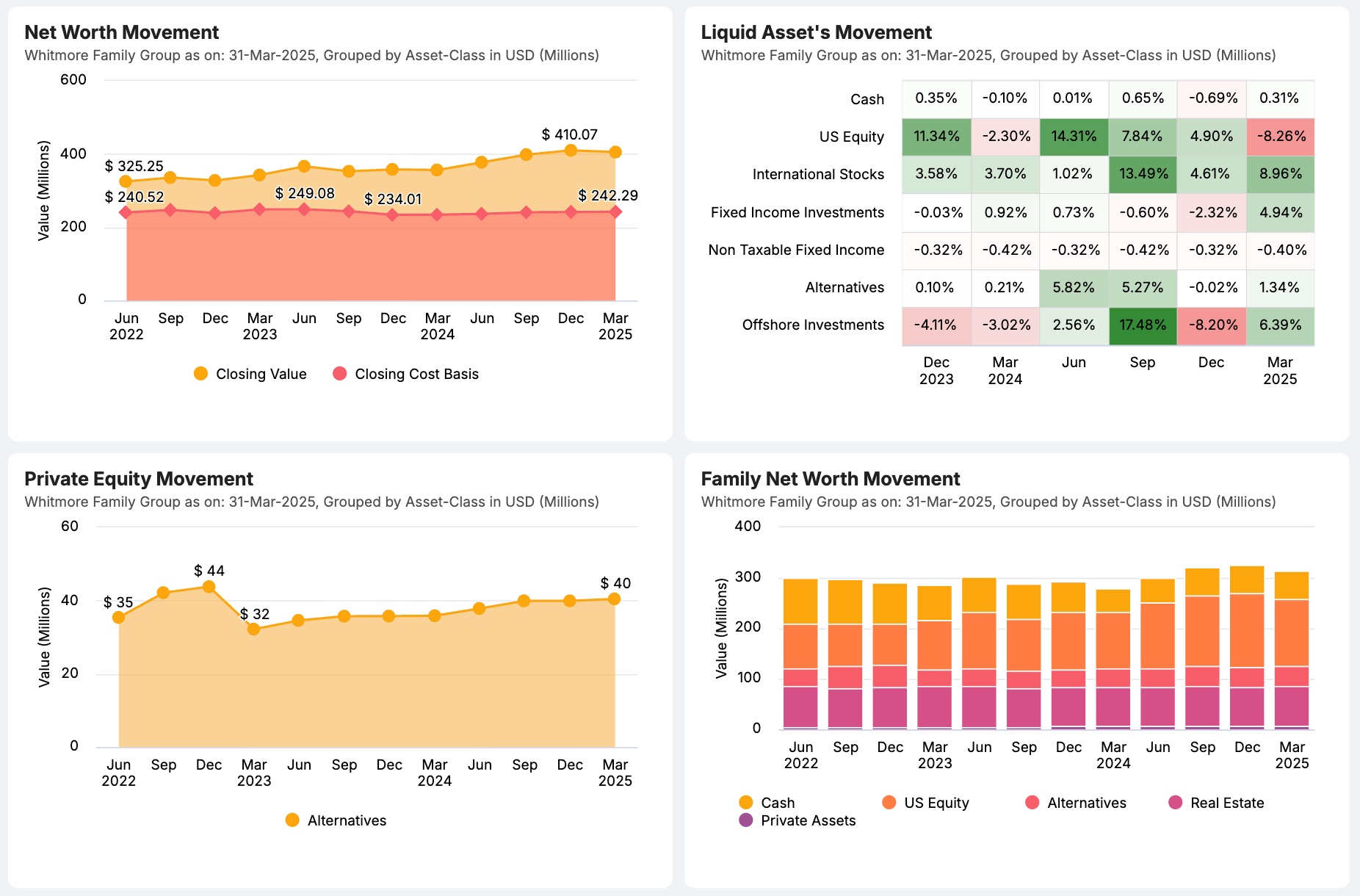

Run a family office like a business with a clear, real-time view of net worth, capital flows, performance, and tax exposure across all entities.

With audit-ready books and full data ownership, make confident, well-informed financial decisions.

Built for the Way Family Offices Actually Operate

Asset Vantage is designed for family offices where entities, assets, and reporting needs grow faster than spreadsheets and stitched tools can handle.

Single-Family

Offices

- Multiple entities, trusts, and holding structures

- Reporting and audit expectations that increase over time

- Need one authoritative view across assets, entities, and ownership

Multi-Family Offices & Institutional Wealth Managers

- Client-level segregation with shared infrastructure

- Consistent reporting standards across families

- Scalable controls without duplicating systems or effort

CPAs & Business

Management Firms

- Supporting family offices across entities and structures

- Responsible for clean books, reconciliations, and reporting timelines

- Need audit-ready numbers they can trust and defend

How Family Offices Use Asset Vantage in Practice

Used by family offices managing multi-entity structures, alternatives, and daily reporting pressure.

From a user perspective, the reports are excellent. We’re able to get information a lot quicker. We have 75 entities and over 150 bank and custody accounts. AV allows us to really consolidate all of it. And we’re very, very happy with the software and the team behind the software.

Family Principal Single-Family Office

New York City, USA

Family Principal Single-Family Office

Mumbai, India

Asset Vantage is not tied to a legacy platform, which makes it unique. I now have partnership accounting capability and can tag my investments with their geography in a user-friendly manner. This has simplified my SFO’s complex financial as per my needs. Working with Asset Vantage’s team is a delight. The people are extremely responsive and work hard to solve issues.

Family Principal Single-Family Office

Jackson, Mississippi, USA

Asset Vantage gave us exactly what we needed: an all-in-one solution that streamlined operations, cut manual work, and let our team focus on what matters most. We finally have a unified, granular view across all our holdings and entities, and at a price that made it a no-brainer. We also love the fact that the service team responds real quick to all our queries, giving us confidence in our roadmap with AV.

Family Office President

Chicago, USA

We were trying to implement accounting and reporting software at our Multi-family Office for the past 12 years. Asset Vantage did an incredible job of understanding our problem, in our language. They said, “let’s solve it” and delivered the exact features we needed. With streamlined and automated processes, our Multi-family Office can now work with more families. I appreciate Asset Vantage’s strategic and long-term approach.

Managing Director, Multi-Family Office

Boston, USA

As our family office grew, the challenge shifted from accessing data to trusting it. Too many systems, constant reconciliations, and time spent explaining variances instead of making decisions. Asset Vantage helped us bring structure and discipline without forcing a rigid framework. We now have clarity across entities, confidence in reporting, and far fewer conversations about why numbers don’t match. That change alone has improved how we operate day to day.

Family Office Director

Francisco

When Family Office Complexity Meets Reality

How a Florida-Based Single-Family Office Transformed Its Reporting from Ad-hoc to Live Daily

How a Chicago-based Accounting Firm Replaced Spreadsheets with an Integrated Family Office Platform to Achieve Scale, Efficiency, and Client Trust

Helping an Asia-Based Family Office Unify Data and Streamline Compliance for Faster, Better Decisions

Built by a Family Office, for Family Offices

Asset Vantage, A UNIDEL Company, was created inside a family office that faced the same reporting, consolidation, and control challenges it now solves.

It was not conceived as a fintech experiment or a reporting layer. It was built from lived operational pain, where numbers had to reconcile, closes had to hold, and accountability was non-negotiable.

Questions That Come Up Before a Decision

1. Is Asset Vantage a wealth advisor or robo-advisor?

Asset Vantage (AV) is not a wealth advisor or wealth manager. AV is a powerful family office accounting and reporting

software designed to offer real-time information about your wealth so you can make well-informed decisions. Our family

office software is neither a robo-advisor nor an online wealth manager, as we do not provide investment products or offer

recommendations on managing your wealth.

2. Why should I be using Asset Vantage?

If you’re looking to consolidate investment data, manage accounting and store your documents all on one platform, the Asset Vantage platform is the perfect solution. It will help you reduce complexity and stay in control of your data.

With AV, you will be fully protected against personnel changes in your family office, ensuring a seamless transition of users with no loss of historical knowledge or data.

AV offers users the ability to access the system anytime and anywhere, reducing dependencies on family office teams, wealth managers, and external advisors.

Your family succession plan will be streamlined with AV, consolidating all your financial and investment data in one place for seamless access.

3. Can I transact through the platform like buy/sell stocks and bonds or make bank transfers?

4. What type of entities and asset classes can I use Asset Vantage for?

Non-standard asset tracking is challenging for all family offices. Asset Vantage’s portfolio reporting software integrates all asset classes, even personal assets such as homes, planes, cars, insurance policies, collectibles, etc.

You can even record liabilities and manage their periodic payments, ensuring a consolidated picture of your true net worth.

5. What kind of family office software is Asset Vantage?

Asset Vantage is a family office accounting software platform designed for single- and multi-family offices, as well as the advisors who support them. It brings accounting, portfolio oversight, and reporting into a single system and is often evaluated by wealth owners as one of the best family office software options for managing complex structures at scale.

6. Is Asset Vantage an accounting system or a portfolio management platform?

Asset Vantage is a portfolio management platform anchored in a single general ledger. It combines portfolio oversight with accounting, performance measurement, and consolidated reporting, allowing families and advisors to manage multiple entities within one system rather than across stitched-together tools.

7. Who is Asset Vantage designed for?

Asset Vantage is designed for wealth owners, single-family offices, multi-family offices, and advisors supporting UHNW families. It is also used by investment companies and business managers who require accounting-grade accuracy, structured investment tracking, and consolidated visibility across entities.

8. How does Asset Vantage help families manage family wealth?

Asset Vantage enables wealth management by allowing families to manage wealth through centralized accounting and portfolio views across entities, investments, and asset classes. By connecting accounting records with portfolio performance, families gain a clear view of net worth, asset allocation, and capital flows in one place.

9. What role does Asset Vantage play in investment management?

Asset Vantage supports investment management by enabling consistent tracking of investments across public markets, private investments, and alternative assets. Performance, cash flows, and valuations are maintained alongside accounting records to ensure accuracy and continuity.

10. How does Asset Vantage support informed investment decisions?

Asset Vantage supports informed investment decisions by combining accounting accuracy, portfolio performance, and market data within a single system. This allows families and advisors to assess exposure, liquidity, and risk in context rather than relying on isolated reports.

11. Is Asset Vantage a point tool or a broader software solution?

Asset Vantage is part of a broader set of software solutions designed for modern family office operations. It functions as a digital wealth platform that integrates accounting systems, portfolio analytics, document management, and reporting into a single environment.

12. Is Asset Vantage used only locally or across regions?

Asset Vantage operates as a global provider, supporting multi-currency reporting, international investments, and family office structures spanning multiple jurisdictions.

1. Is there a restriction to the number of login IDs per license?

No, the system allows you to create unlimited user login IDs per license, regardless of which edition you have

subscribed to.

2. Can I define user permissions for designated advisors, accountants, and family members?

3. Is there a record of all user activity on the system?

1. Where is my data being stored and can I take a backup?

2. Can I access the data remotely and from my mobile devices?

3. How does the system handle backups, and can they be done by individual entity?

1. Who has access to my data, and how is privacy maintained?

2. Is Asset Vantage SOC compliant, and how does it ensure data security?

3. How does Asset Vantage support compliance and audit requirements for family offices?

1. Can data from different sources be synced and uploaded to the AV platform?

2. In what format can financial data be uploaded and entered on Asset Vantage?

3. Can I review my holdings across different parameters?

4. Can I compare annualized performance of my various wealth advisors?

5. Does the platform support benchmarking?

6. Can I review performance analytics at the group or family level?

7. Can I tag holdings to asset classes as per my preference?

8. Can I create my own customised Dashboard?

9. How do I know the coupon frequency of a bond? Is this based on market data?

10. How does the system handle dividend re-investments?

11. Can I view a real estate report by property?

12. How do I keep my investment, bank and credit card transactions updated?

You can also upload bank statements to populate and categorize transactions. Once this data is categorized, the system will automatically create and update your books of accounts. We support hundreds of institutions and have activated over 5,000 global data feeds across banks, credit cards, and custody accounts.

13. Can I upload and store important documents in digital formats?

14. Can I consolidate data for international assets?

15. How do I update values of all my illiquid assets?

1. Does the system generate short-term and long-term gains reports for investments, and income and expense reports?

2. With automated accounting, how are ledgers created?

3. What kind of accounting reports does the platform create?

4. What format is the balance sheet prepared in?

5. Can we print journal entries generated on the system?

6. Can Asset Vantage help with tax reporting and gain/loss tracking?

1. How does Asset Vantage integrate with banks and custodians?

2. What happens if a data feed is temporarily unavailable?

3. Can I still use AV if my institution doesn’t support direct feeds?

1. How does my portfolio stay updated?

2. Can I review annualized returns (IRR/TWR) since inception and for a specific period?

3. Does the system compute asset allocation over time?

1. Can we sync Asset Vantage with third party accounting software?

2. Is Asset Vantage integrated with a bill payment platform?

3. Does AV support Payroll functionality?

4. Does AV support accounting for business operating entities?

5. Does AV keep audit history of transactions?

1. Can we sync Asset Vantage with third party accounting software?

2. Is Asset Vantage integrated with a bill payment platform?

3. Does AV support Payroll functionality?

4. Does AV support accounting for business operating entities?

5. Does AV keep audit history of transactions?

1. What is the Document Vault, and how is it useful?

2. How does Asset Vantage ensure the security of my uploaded documents?

3. Can I control who in my team has access to certain documents?

4. Where can I upload or attach documents in Asset Vantage?

- Entity/Group Level: Via Menu > Masters > Entity/Group -useful for organizational or ownership-based documents.

- Transaction Level: Via Menu > Transactions – ideal for attaching invoices, statements, or proof documents tied to specific transactions.

- Document Vault: Via Menu > Document Vault- a centralized repository that displays all documents uploaded across entities, groups, and transactions.