Family Office Software Built by a Family Office,

Trusted Worldwide

Gain ultra-high visibility across complex portfolios with

AV’s integrated general ledger and performance reporting platform

Take Control of Financial Data for Informed Investment Decisions

Asset Vantage gives UHNW families ultra-high visibility into complex investment portfolios, replacing manual data handling with a consolidated, decision-ready view. Built for modern family offices and their trusted advisors, the platform centralizes investment data aggregation across multiple entities to deliver accurate portfolio oversight.

Asset Vantage enables family offices to:

- Aggregate investment data across multi-asset portfolios, including private investments, venture capital, hedge funds, and illiquid assets

- Access performance reporting, full general ledger accounting, and secure document management and document storage

- Maintain consistent portfolio management, investment tracking, and portfolio data from a single source of truth

- View a consolidated picture of a family’s entire net worth across multiple entities

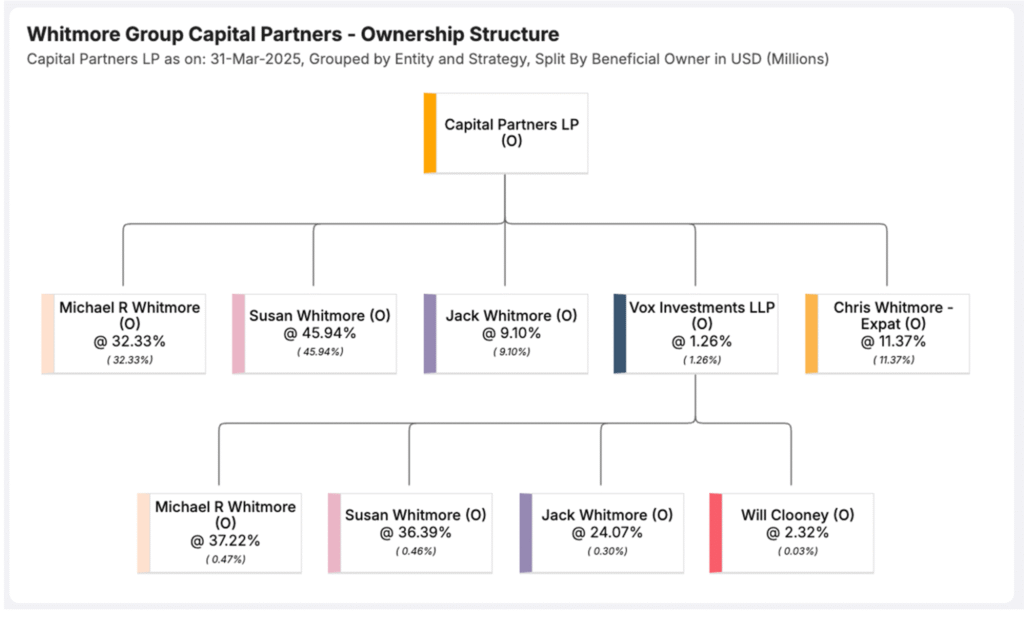

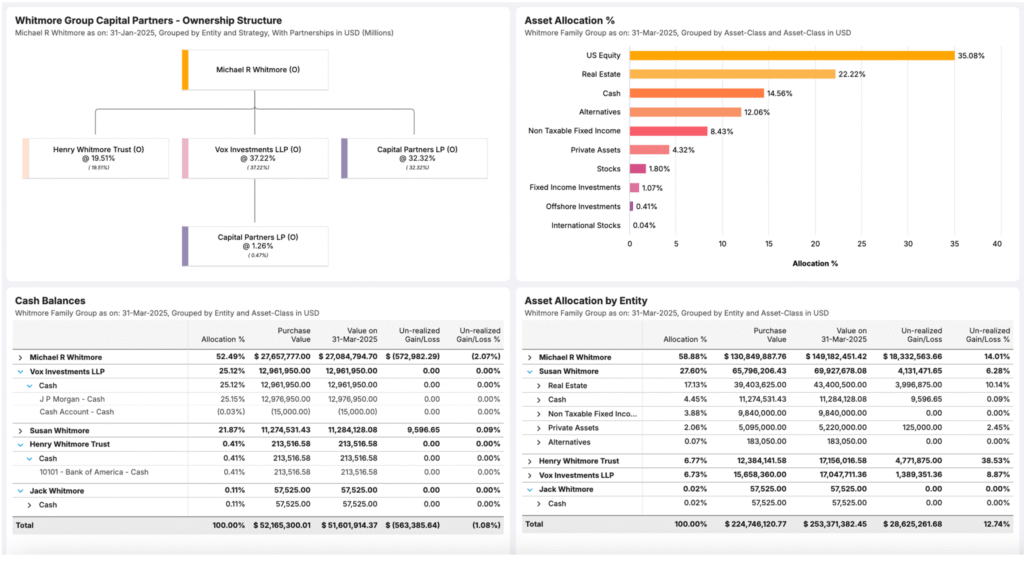

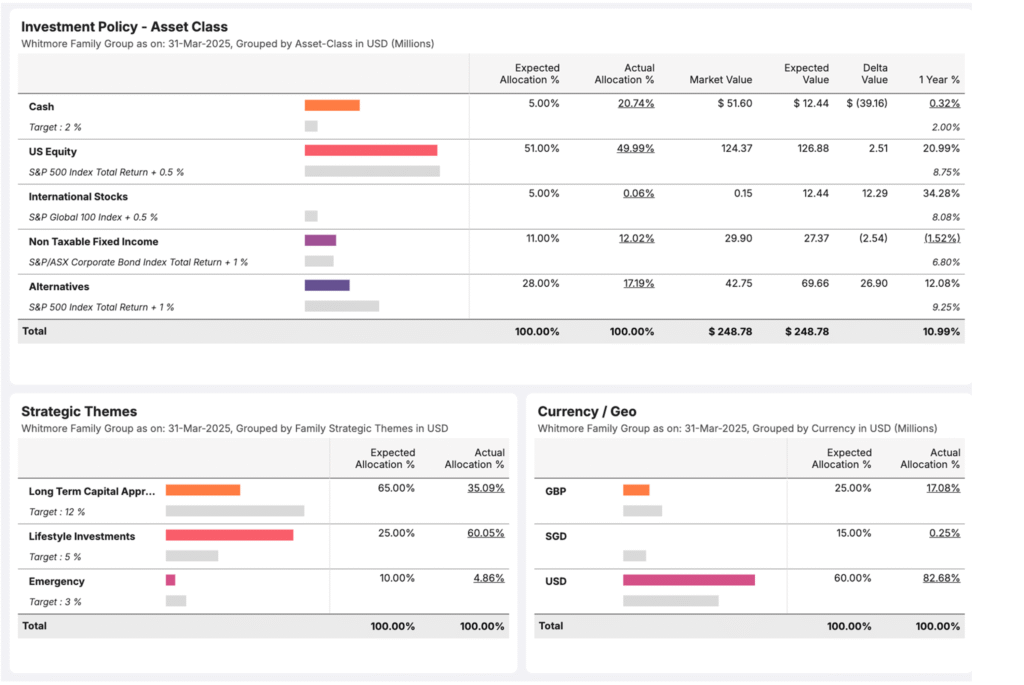

Aggregate Wealth Data Across Single and Multi-Family Offices

UHNW wealth is spread across partnerships, trusts, foundations, individuals, and LLCs. For single and multi-family offices, fragmented structures make investment management and portfolio oversight difficult without consolidated data across entities.

Asset Vantage supports complex ownership structures across partnerships, trusts, and entities, keeping consolidated data accurate at every level. It combines portfolio oversight with general ledger accounting to ensure consistency across multiple entities.

Asset Vantage enables family offices to:

- Aggregate investment data into consolidated data for accurate portfolio oversight

- Track partnership accounting, capital calls, and expense management

- Support collaboration between family members, asset managers, wealth managers, and investment managers

- Rely on proven accounting software and accounting solutions trusted by financial institutions

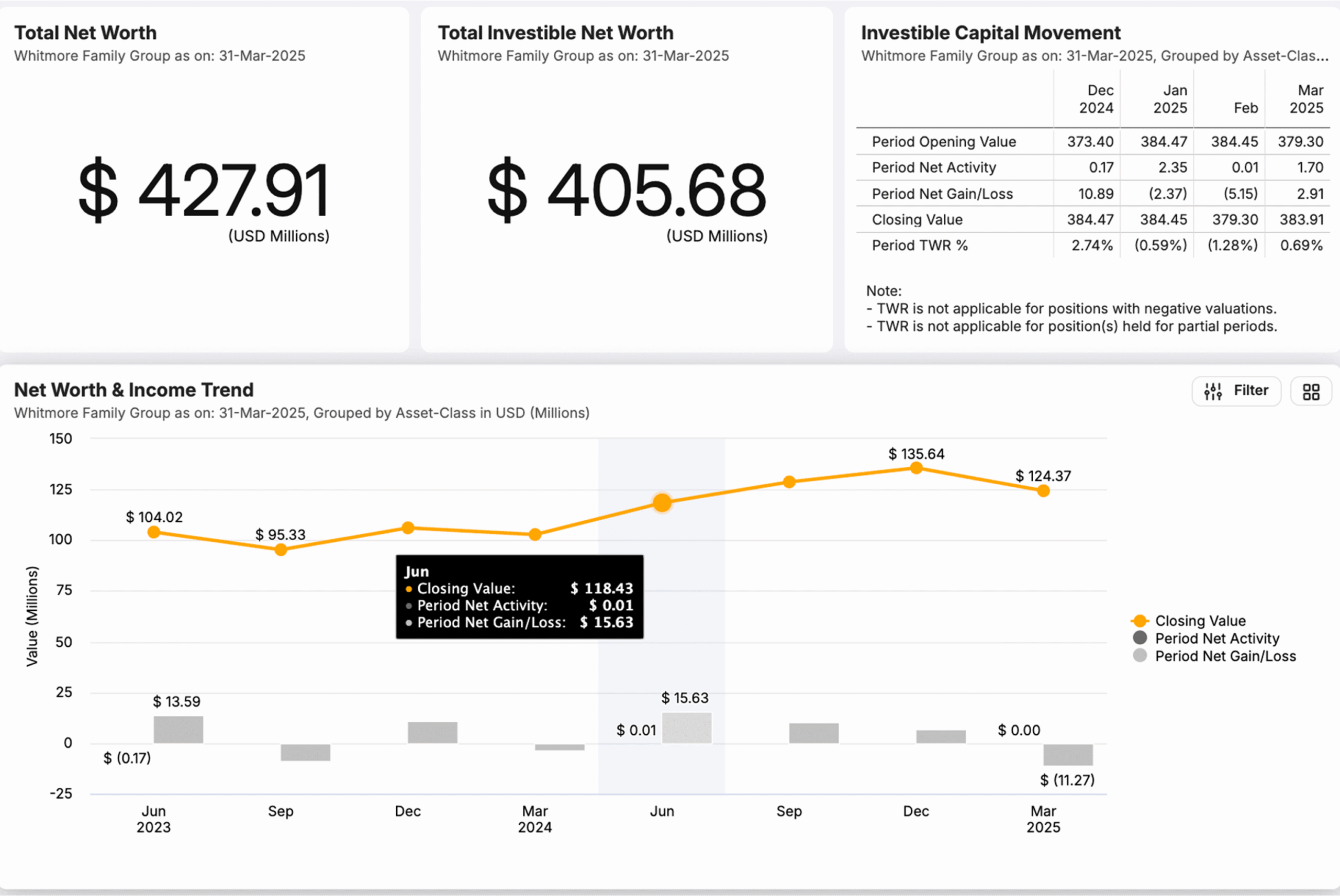

Performance and Allocation Reporting for Portfolio Analytics

Asset Vantage provides single- and multi-family offices with clear performance and allocation reporting, built for how wealth owners and advisors actually review portfolios.

Asset Vantage enables family offices to:

- Analyse portfolio performance using IRR, TWR, benchmarks, and risk metrics across asset classes

- Generate detailed data visualization with drill-downs by portfolio, manager, or entity

- Combine individual reports into consolidated views while managing multiple entities

- Share decision-ready insights with wealth advisors, business managers, and investment firms

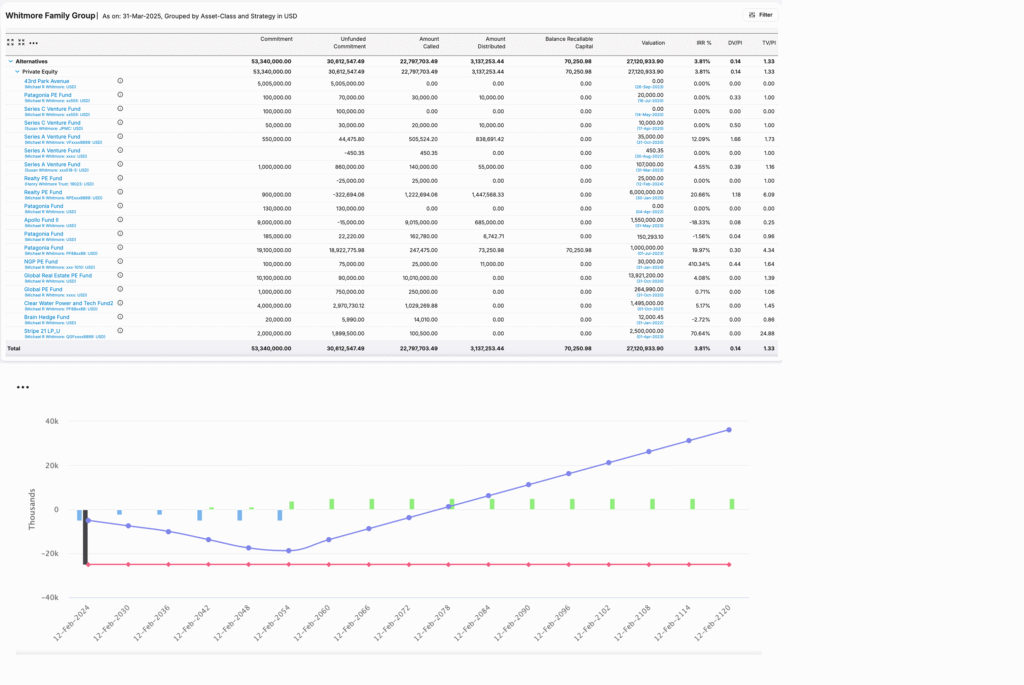

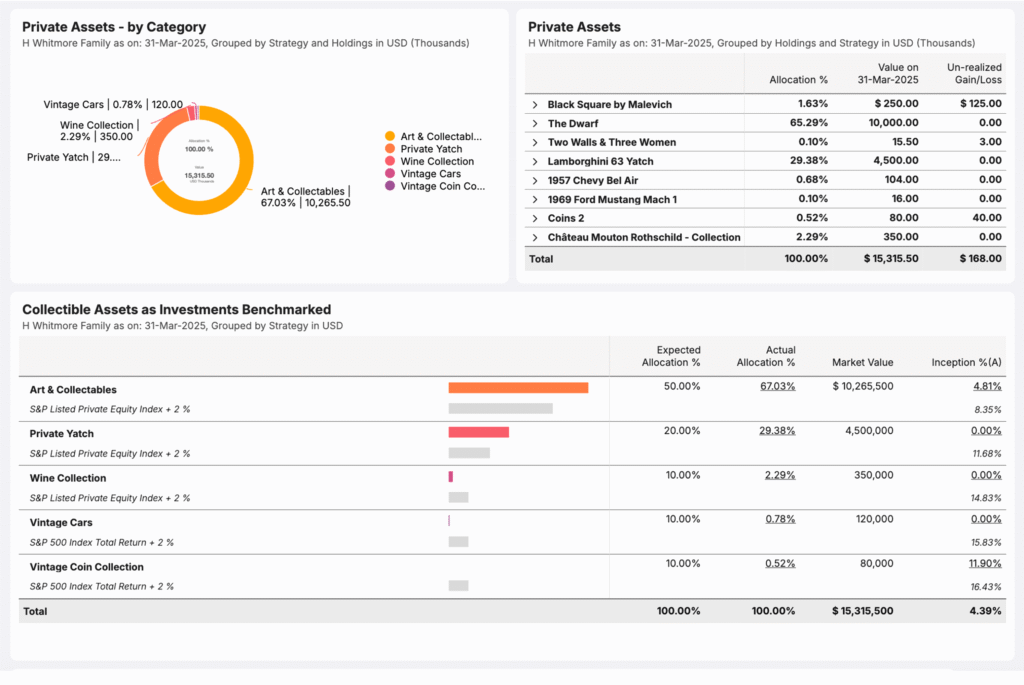

Alternative & Private Equity Investment Reporting

Private assets, including private equity, require reporting that stays aligned with accounting systems to remain visible and controlled.

Asset Vantage brings alternative investment reporting directly into consolidated net worth through accurate, structured data capture within accounting systems. As delivers a clear, reliable view across investment companies without breaking data integrity.

Asset Vantage enables family offices to:

- Track private equity performance, cash flows, and investment multiples with confidence

- Monitor commitments and unfunded commitments across entities

- Maintain consolidated alternative views within wealth management software

Track Personal Assets Within a Wealth Management View

Asset Vantage helps families manage their wealth with a unified view of personal assets and investments.

Personal holdings are captured and reported in the same software used by family offices, reducing manual effort by automating data entry and ensuring consistency in net-worth reporting.

Asset Vantage enables family offices to:

- Analyse performance and asset allocation across portfolios, managers, and time periods using consistent, accounting-aligned data.

- Maintain a consolidated view of family wealth

- Reduce manual tracking through structured, system-led data capture

Multi-currency control for Risk and Global Investment Management

Asset Vantage gives family offices clear visibility into assets held across currencies and geographies, so currency exposure is understood, not guessed.

Multi-currency reporting stays consistent across entities, eliminating manual reconciliation and fragmented views.

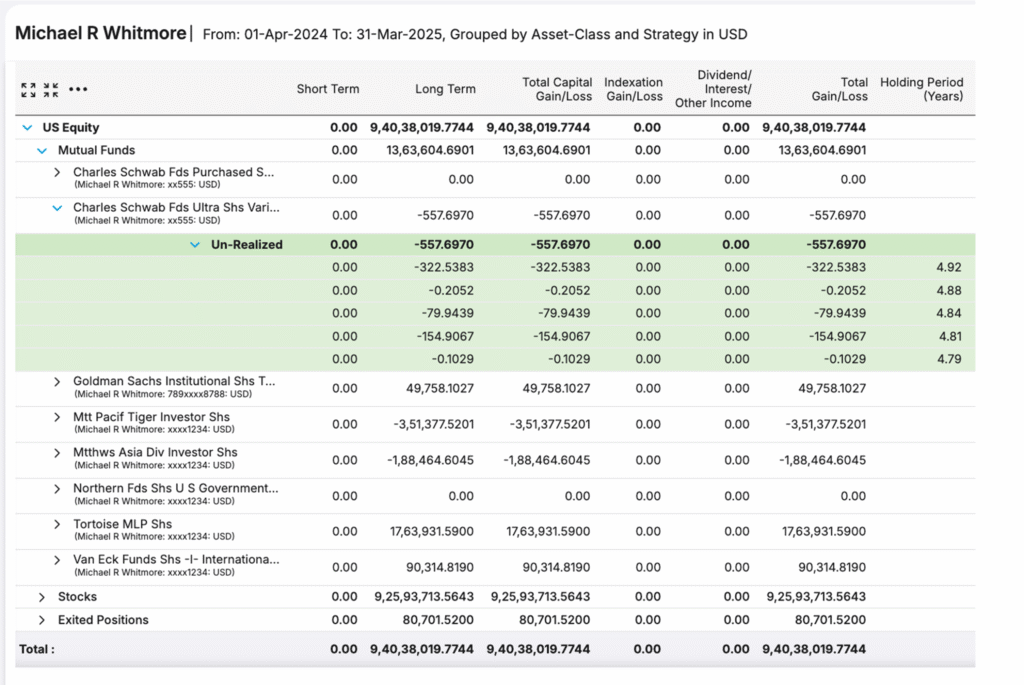

Tax Reporting That Improves Operational Efficiency

AV delivers ‘Accountant-Ready’ tax reports, saving time by providing easy, consolidated reporting for individuals and family limited partnership entities such as LLCs, trusts, and more.

Tax reporting remains consolidated across LLCs, trusts, and partnership structures, allowing accountants to work directly from clean, consistent outputs without manual reconciliation.

Serving Family Offices and Their Trusted Wealth Custodians