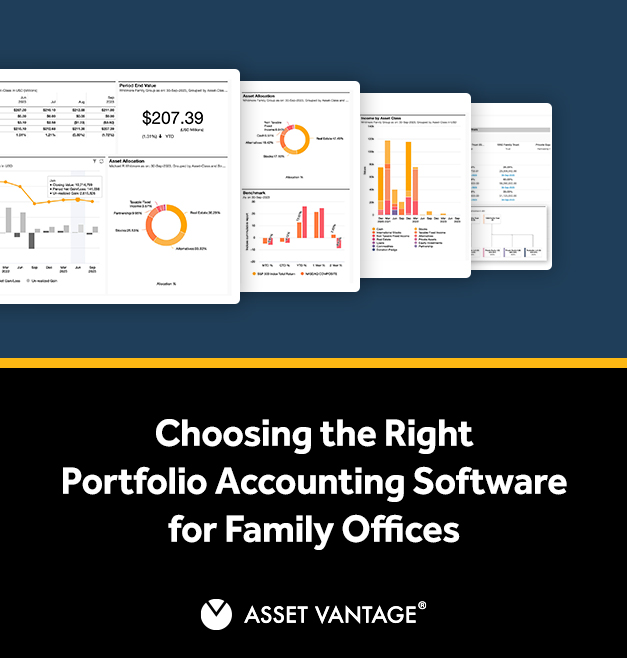

How Family Office Software Tracks Wealth Across Multiple Asset Classes

21 October, 2024The financial affairs of Ultra-high-net-worth (UHNW) households are managed by family offices that handle large and varied portfolios made up of real estate, private equity, and alternative assets. Since financial data are

READ MORE