Read Time5 Mins

As per a report by Deloitte, the wealth managed by family offices globally is estimated to touch USD 9.5 trillion by 2030. This makes it critical for Single Family Offices to select the best investment management software.

The key advantages are:

1. Gain a complete view of your family’s net worth.

2. Automate financial processes.

3. Generate timely actionable reports to make better investment decisions.

4. Provide a configurable view of sensitive data to third parties.

5. Securely store business-critical documents.

6. Access on demand to your family investment portfolio

Here’s a snapshot of how a family office software can enable you to efficiently manage your investment transactions and financial accounting.

Running a family office without the powerful capabilities of an automated software (listed above) can be tough.

To help you select the best investment management software, we have compiled a list of features to consider before making your final purchase.

1.Financial data aggregation across all asset types – liquid, alternate, and private assets

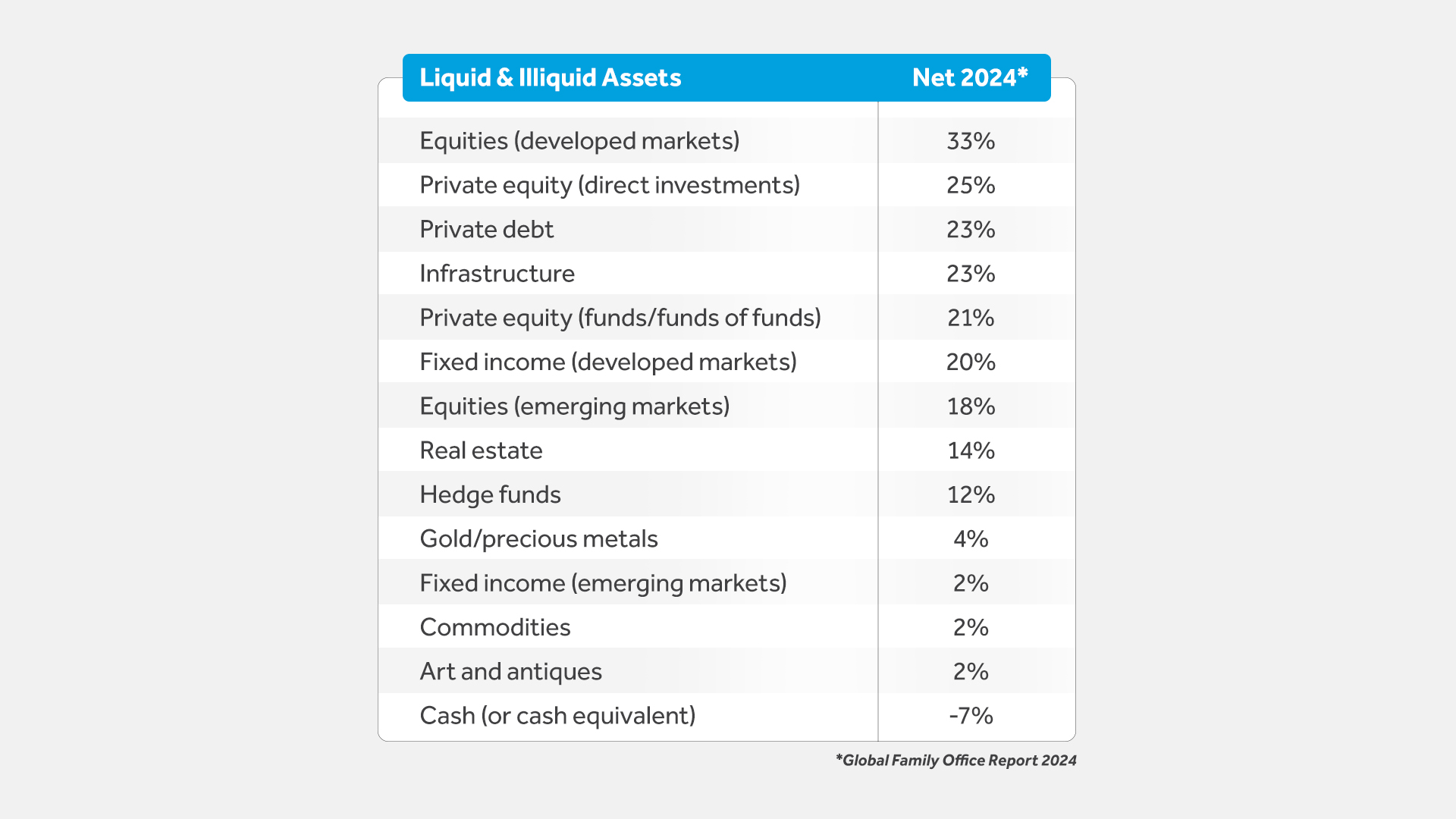

Look at the graphic below. It highlights the net increase in the percentage of family offices planning to boost their allocation across various asset classes, including equities, fixed income, real estate, and art collections (in decreasing order). For instance, 33% of family offices intend to increase their allocation to equities in developed markets.

With so many diverse asset classes to manage simultaneously, manual efforts to aggregate financial data can be quite daunting.

But, by implementing a software for family offices, you can eliminate the time and effort required to collect financial data across diverse assets. Just imagine the spike in operational efficiency you’ll experience by assigning your team to perform complex data analysis instead of tracking and consolidating data across multiple sources!

The best investment management software helps gain a comprehensive view of your wealth without any manual efforts.

2. Integrated general ledger for automated accounting and reconciliation of financial data

Aggregating financial data across assets is the first step, which is followed by maintaining accurate financial records using an integrated general ledger.

Why?

Because it allows:

-Centralized book–keeping by consolidating all financial transactions into a single platform.

-Compliance with international accounting standards like IFRS and GAAP.

-Elimination of double entries and manual errors by automating financial processes.

-Detailed insights into transaction and journal entries with custom filters and drill-down capabilities.

-Better record-keeping by tagging documents to specific transactions making their retrieval easier.

The best investment management software enables reconciliation of financial data by minimizing errors and reducing manual data entry.

Read: how AV’s powerful integrated performance reporting and general ledger platform enhanced the operations of this Florida-based single-family office with its fully managed book-keeping, reconciliation and reporting service.

3. Comprehensive portfolio reporting across all asset classes, currencies, advisors, and geographies

Once you have access to financial data and error-free reports on a single platform, the next obvious step is to check how your investments are performing.

After all, wouldn’t it defeat the purpose of implementing the best investment management software if it fails to evaluate just that – investment performance?

The wealth of UHNW families is highly diversified, comprising liquid and illiquid assets, managed by multiple advisors and custodians, denominated in various currencies and held across multiple entities. These factors make generating accurate performance reports and complying with international reporting standards such as IFRS and GAAP particularly challenging, especially when relying on generic family office software.

This indicates a clear need of a software for family offices that provides an on-demand view of portfolio performance and simplifies complex investment details.

The best investment management software will address portfolio reporting challenges by allowing you to:

-Monitor portfolio performance across asset classes and investment strategies.

-Generate customized performance reports based on user-defined groups of entities, advisors, currencies, sectors, geographies, liquidity, and other unique tags to make better informed decisions.

-Evaluate performance based on time-weighted or cash-flow metrics across asset classes.

-Analyze the performance of illiquid assets through metrics like Internal Rate of Return (IRR) and compare them with public market equivalent benchmarks.

-Assess the return and risk of advisors’ investment strategies compared with suitable benchmarks.

The best investment management software allows granular analysis of asset classes, investment strategy compliance, advisor performance, and more through actionable performance reports.

4. Access controls to provide a configurable view of sensitive data

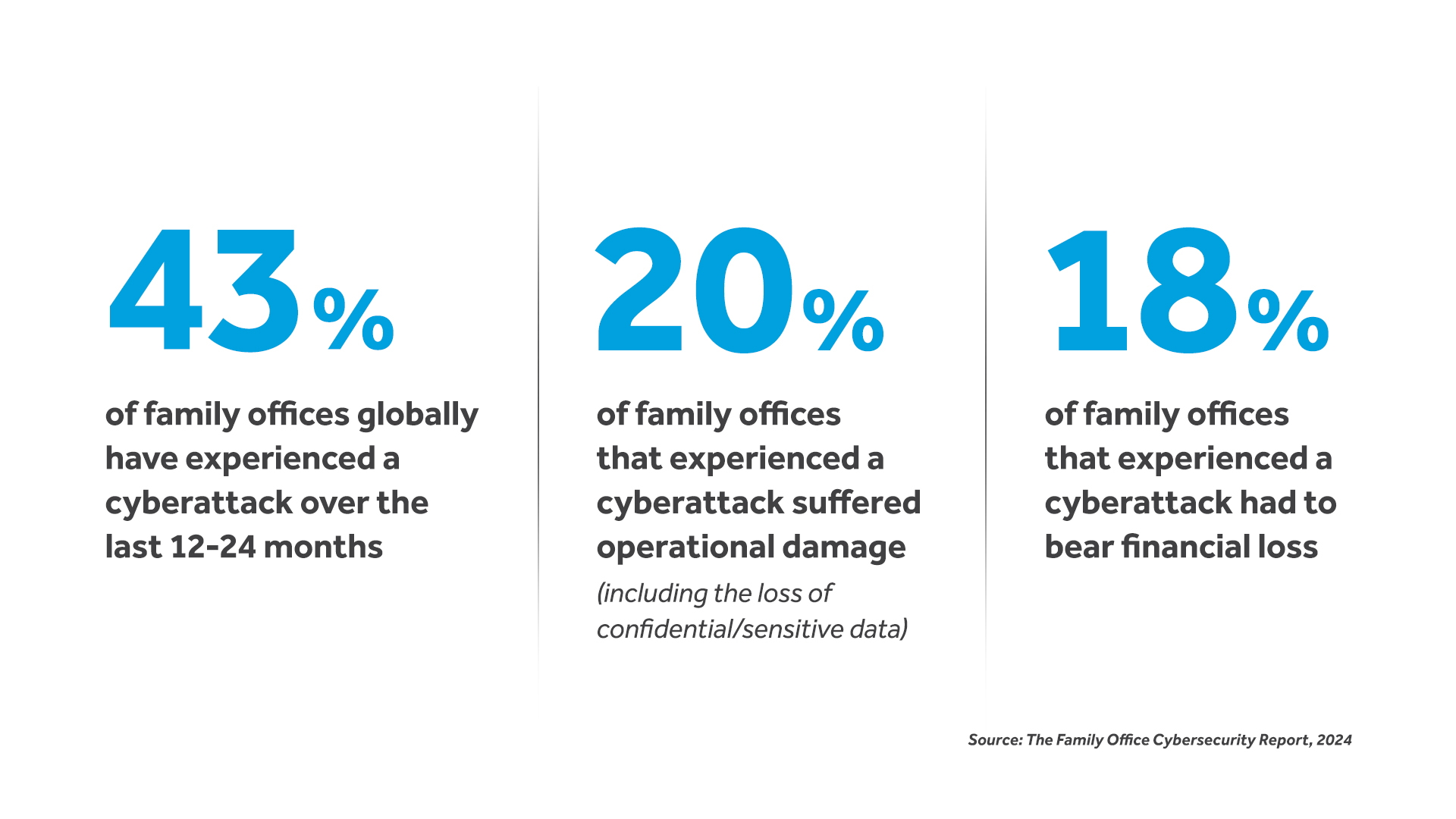

The infographic below paints a stark picture of the rising terror of cybersecurity issues across family offices.

What’s even more interesting is that only 26% of family offices claim to have a robust cybersecurity plan in place.

This report shows that most family offices have adopted only basic security protocols, such as strong passwords/multifactor authentication (85%), data backups (72%), and cybersecurity staff training (58%).

Here are a few cut-off parameters to ensure ‘round-the-clock protection’ from the investment management software you choose:

-Permits only authorized individuals to access sensitive data.

-Provides a configurable view of sensitive data to authorized individuals.

-Maintains a comprehensive audit trail to track data activity by user session.

-Allows independent setting of read, add, and delete permissions for documents by configuring user access controls.

The best investment management software allows you to maintain full ownership of your private data.

Now that you know the key ingredients for selecting the best investment management software, you can start exploring on your own.

But before you go, we strongly encourage you to explore the powerful capabilities of the Asset Vantage (AV) platform — the workhorse solution that empowers over 350 of the world’s wealthiest families to manage combined assets of over $300 billion.

AV’s SaaS technology-based asset management, accounting, and reporting system provides financial data aggregation across all asset classes, an integrated general ledger for accounting and reconciliation, and comprehensive portfolio reporting across all asset classes, currencies, advisors, and geographies. So, whether you are an individual wealth holder or a fully staffed family office, or a professional that serves them; AV’s best-in-class technology, combined with its premium managed services offers an unparalleled and highly configurable solution at a fully transparent and competitive price point.

Contact us today to explore the full capabilities of the AV PRO platform and get a scalable solution that grows with your UNHW business needs.