Read Time11 Mins

- What Is a Family Office Structure?

- Origins of Family Offices

- Why Families Create Family Offices

- Services Family Offices Provide

- Types of Family Offices Explained

- Comparing Family Office Types

- Costs and Entry Thresholds

- Choosing the Right Model

- Embedded and Hybrid Family Office Models

- The Future of Family Offices

What Is a Family Office Structure?

Origins of Family Offices

Family offices trace their origins to the 19th century, when ultra-wealthy families such as the Rockefellers created private wealth management firms dedicated to overseeing their estates. These early offices focused on portfolio management, property management, and succession planning.

Over time, the sector evolved into distinct models, particularly the single-family office and multi-family office, as families sought new ways to balance control, cost, and expertise. Today, family offices are among the fastest-growing segments of global wealth management, reflecting the needs of families with complex business interests and intergenerational assets.

Why Families Create Family Offices

- Centralized wealth management: Aligning investment planning, tax reporting, and risk management in one structure.

- Managing family business interests: Coordinating governance between the family enterprise and family wealth.

- Succession planning and governance: Preparing future generations for leadership through clear governance frameworks.

- Personalized services: Offering concierge services, lifestyle management, and bill pay to reduce administrative burden.

- Education and literacy: Supporting financial literacy and wealth education so family members can take informed roles in governance.

Services Family Offices Provide

Although family office types differ, most offer a core set of wealth management services that combine financial and personal support:

- Investment advisory and portfolio management to preserve and grow the family’s assets.

- Financial planning to align liquidity, wealth plans, and investment objectives.

- Tax planning and reporting for domestic and cross-border compliance.

- Concierge services and lifestyle management to handle personal affairs, property management, and travel.

- Risk management and financial management to protect against market, operational, and family office risks.

- Succession planning and governance advisory services to prepare heirs and maintain stability.

- Wealth education and financial literacy programs to equip younger family members for stewardship.

In practice, family offices provide not just financial oversight but also a trusted environment for balancing wealth with family dynamics, ensuring that assets and legacy endure across generations.

Types of Family Offices Explained

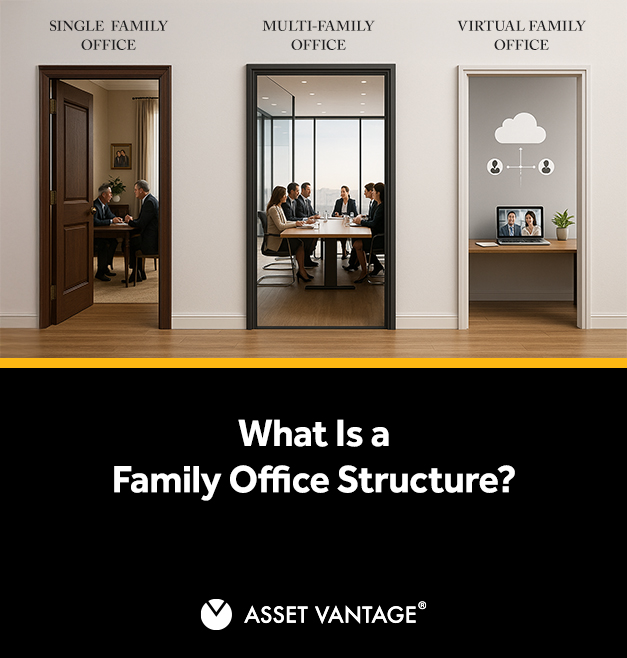

Family offices exist in three main models, single-family, multi-family, and virtual, each balancing control, cost, and family governance in different ways. While all offices provide investment management services, the scope of support, reliance on outsourced partners, and degree of personalization vary significantly. Understanding these differences helps wealthy families choose the structure that best safeguards their wealth, vision, and legacy.

Single-Family Office

Definition and Purpose

A single-family office (SFO) serves one wealthy family through a dedicated team that oversees financial planning, portfolio management, tax reporting, and personal affairs. It represents the most comprehensive and private model, offering not only wealth management services but also concierge services, lifestyle management, and advisory services tailored exclusively for one household.

Who Needs a Single-Family Office

The single-family office sector is best suited for ultra-wealthy families (typically US$100 million+ in investable assets). Families that benefit most include those with:

- Complex investment portfolios across asset classes, including private equity and alternative investments.

- Multiple legal entities, trusts, and cross-border tax exposures.

- Intergenerational needs for wealth transfer planning and education of future generations.

- Significant family business interests requiring integrated oversight.

Growth and Relevance

The single-family office sector has seen notable growth as more families seek privacy, direct control, and continuity. The rise of single-family office growth reflects how ultra-wealthy families increasingly view SFOs as governance institutions, not just service hubs. However, maintaining such an office requires significant wealth and exposes families to family office risks if governance is not professionalized.

Multi-Family Office

How Multi-Family Offices Work

A multi-family office (MFO) serves multiple families by pooling resources for investment management, financial and personal needs, and family governance. This model allows families with significant wealth (US$25–50 million+) to access professional expertise without bearing the full cost of an in-house office.

Cost Efficiency and Governance

By sharing infrastructure, MFOs deliver:

- Cost efficiency across technology, reporting, and compliance.

- Access to seasoned family office advisors who support both financial and governance needs.

- Effective risk management by leveraging institutional-grade systems.

- Other services such as succession planning, philanthropy, and education for family members.

Virtual Family Office

Outsourced Family Office Model

A virtual family office (VFO) operates through an outsourced family office model. Instead of hiring a full in-house team, families rely on external providers such as investment advisors, accountants, legal counsel, and concierge service firms to deliver the same functions. Digital platforms and ERP systems unify investment planning, tax reporting, and lifestyle management. Families can mitigate risks by using ERP systems and disciplined reporting to reduce fragmentation.

Benefits and Limits of Virtual Offices

- Flexibility in choosing advisory services and providers.

- Lower overhead, since staffing costs are avoided.

- Ability to scale services as family needs evolve.

- Families may lack the personalized services of a single-family office.

- Oversight depends on effective coordination of multiple service providers.

- Without discipline, families risk inconsistent reporting and fragmented governance.

| Type | Definition & Purpose | Who It Serves | Core Services | Benefits | Trade-Offs / Risks |

|---|---|---|---|---|---|

| Single-family office (SFO) | Dedicated team managing one wealthy family’s financial and personal needs | Ultra-wealthy families with complex investment portfolios, multiple entities, and succession planning needs. Typical thresholds: – US: US$250m+ families can sustain a dedicated office. Practical reality: Families in the US$50m–200m range often choose MFOs, CPA firms, or VFOs, sometimes with part-time staff, but outsourced providers own their data. | – Investment management and portfolio management – Tax planning and reporting – Concierge services and lifestyle management – Advisory services for governance and philanthropy | – Full control and privacy – Deep alignment with family’s values – Tailored education and financial literacy for future generations | – Typically high cost (US$0.5+m annually) – Requires significant wealth – Governance weakens when it relies on individuals instead of systems |

| Multi-family office (MFO) | Shared platform serving multiple families through pooled resources | Families with significant wealth (US$25–50m+) seeking scale and access to professional expertise | – Financial planning and investment advisory – Succession planning and family governance – Other services: philanthropy, education, risk management | – Cost efficiency by sharing infrastructure – Access to a broader pool of experts and technology – Institutional-quality oversight | – Less personalized services than SFOs – Governance must balance needs of different families – Standardized processes may limit flexibility |

| Virtual family office (VFO) | Outsourced family office model using external providers and digital tools | Affluent families (<US$25m) who want oversight without the cost of a dedicated team | – Advisory services (tax, legal, investment) – Wealth management services via private banks – Lifestyle management and concierge providers – Technology-driven reporting | – Flexible and scalable – Lower cost, avoids in-house staff – Families can choose providers freely | Reporting can become inconsistent when information comes from multiple providers. Families rely on shared service providers who may not be available at their beck and call. It can also limit real-time oversight. The model lacks the day-to-day intimacy and trust of a dedicated in-house team. |

Comparing Family Office Types

Each family office type offers a different balance of investment planning, governance, and family services. The choice depends on wealth levels, complexity of family business interests, and how much control or efficiency the family values. Lessons from other family offices show that governance discipline often matters more than structure itself. By comparing models side by side, wealthy families can understand what each structure truly offers and what risks to watch for.

Investment and Wealth Management

- Single-family offices tailor asset management and investment planning to one family’s goals, often with bespoke strategies for preservation and growth. Their rise reflects steady single-family office growth among ultra-wealthy families seeking privacy.

- Multi-family offices pool assets from multiple families, creating scale for broader investment advisory services, private equity access, and consolidated portfolio management. Many family offices in this sector position themselves as cost-efficient alternatives for those below the SFO threshold.

- Virtual family offices rely on outsourced advisors and digital platforms to deliver wealth management services without building a full team. They reduce overhead but require strong integration to avoid fragmented oversight.

Governance and Succession Planning

- Single-family offices institutionalize governance for a single wealthy family, embedding controls that extend legacy to future generations.

- Multi-family offices provide structured succession planning, but must balance governance across other family offices and shared advisors.

- Virtual models depend on external professionals for succession and family governance, which can work well if the family maintains discipline, but create family office risks if reporting and authority are unclear.

Lifestyle and Concierge Services

Regardless of model, family offices provide concierge services that go beyond finance:

- Bill pay, property management, and lifestyle management to reduce administrative burden.

- Personalized services like travel planning, household staffing, and coordination of personal affairs.

What differs is delivery. Single-family offices offer these through an in-house dedicated team, while multi-family and virtual models rely on outsourced family office advisors or third-party providers.

Dedicated Team vs Outsourced Services

- Single-family offices employ a dedicated team of investment managers, accountants, and lifestyle staff. This ensures intimacy and control but comes at high cost.

- Multi-family offices share teams across clients, striking a balance between professionalization and efficiency.

- Virtual family offices operate as an outsourced family office, where technology coordinates inputs from advisors. This model scales easily but depends on quality of providers.

Technology in Modern Operations

Costs and Entry Thresholds

The cost of running a family office depends on two factors: the level of wealth a family controls and the structure chosen. Entry thresholds and fee models ultimately determine whether a single-family, multi-family, or virtual family office is feasible. Each family office offers a distinct balance of cost, control, and governance. The right fit depends on wealth level, family dynamics, and long-term legacy goals. For wealthy families, understanding these thresholds is essential before committing resources to either an in-house team or an outsourced family office.

Minimum Wealth Requirements

| Type | Minimum Wealth | Rationale |

|---|---|---|

| Single-family office | Typically US$250m+ in the US Typically INR 100cr+ in India |

Suitable for a single wealthy family with complex investment portfolios, multiple entities, and intergenerational needs. The cost of employing a full dedicated team can only be justified at this level. |

| Multi-family office | ~US$50m–200m | Enables multiple families to share infrastructure, gain access to professional advisors, and spread fixed costs while still receiving institutional-quality wealth management services. |

| Virtual family office | <US$25 million | Works best for affluent families below the threshold for maintaining an in-house office. The outsourced family office model coordinates tax, reporting, and financial management through external providers. |

Fee Structures

Family office fee structures vary, but typically fall into three categories:

- Asset-based fees: Common for multi-family offices, usually 30–100 basis points on assets under management.

- Flat retainers: Reflect the complexity of services and are often used for single-family offices.

- Hybrid models: Combine flat fees with performance- or service-based charges.

Virtual family offices reduce overhead by relying on external providers, but this can limit control and create dependency on service quality. By contrast, a single-family office offers maximum autonomy but at the highest cost, while a multi-family office balances cost efficiency with access to professional expertise.

Choosing the Right Model

The choice of family office type is not one-size-fits-all. The right structure depends on wealth level, family dynamics, governance needs, and long-term family legacy goals. Families that understand both the benefits and the risks of each model are better positioned to choose a structure that safeguards their family wealth across generations.

Key Factors to Consider

- Level of wealth: A single wealthy family with more than US$100 million may justify a private structure, while those with less may benefit from shared or outsourced models.

- Number of family members: Larger households often require more structured governance and education programs.

- Complexity of family business: Families with significant business interests may find an embedded or hybrid model more effective.

- Governance capacity: Strong internal discipline lowers the risk of fragmented reporting and family office risk.

- Future growth: The rise of single-family office growth shows that as assets expand, families often move from shared to dedicated structures.

Tax Planning and Reporting Needs

- Single-family offices manage tax reporting, estate structures, and wealth transfer planning in-house.

- Multi-family offices coordinate these functions across multiple families, giving cost efficiency but sometimes less flexibility.

- Virtual offices rely on external providers, which can work well but require careful integration of systems.

Family Vision and Legacy

A family office should reflect the family’s values and support the long-term family vision. Beyond financial oversight, this includes:

- Building financial literacy for the next generation.

- Supporting wealth education so heirs can manage complex portfolios.

- Aligning investment choices with the family’s legacy and philanthropic goals.

| Type | Best Fit | Family Office Offers | Key Watchouts |

|---|---|---|---|

| Single-family office | Ultra-wealthy families with complex assets and succession focus | Full privacy, control, and tailored governance | High cost; requires scale; risk of dependency on individuals |

| Multi-family office | Families with significant wealth seeking cost sharing and professional oversight | Broad range of wealth management services, shared expertise, and institutional infrastructure | Less personal; standardization across many family offices may not fit every family’s needs |

| Virtual family office | Families below US$25m who want flexibility and lower overhead | Access to outsourced family office services, tax support, and financial management tools | Dependent on provider quality; may face reporting gaps if not integrated |

Embedded and Hybrid Family Office Models

Beyond the traditional three, some families use embedded or hybrid structures to meet tailored financial and personal needs. These approaches often emerge when a family’s wealth is closely linked to its business interests, or when it wants the flexibility of combining in-house expertise with outsourced providers.

What Is an Embedded Family Office

An embedded family office operates within the family enterprise itself. Instead of building a standalone entity, the family integrates wealth oversight into existing corporate functions. This model aligns asset management, tax planning, and governance with the strategy of the business.

- Works best when family’s assets are deeply tied to operating companies.

- Provides intimate knowledge of both corporate and household affairs.

- Reduces duplication by using systems already in place.

Partnerships With Financial Institutions

A hybrid family office blends the two extremes. Families may maintain an in-house team for governance and reporting, while outsourcing functions like tax reporting, risk management, or concierge services. The model balances control with efficiency.

- Advantages:

- Retains authority over sensitive governance matters.

- Leverages external providers for effective risk management.

- Offers flexibility to expand or contract services as family wealth evolves.

- Risks:

- Requires disciplined coordination between in-house and external teams.

- If poorly managed, can create overlap or gaps in accountability.

In practice, hybrid offices are attractive where a family office offers both personalization and efficiency, without the full overhead of a dedicated single-family office.

The Future of Family Offices

The next generation of family offices will combine digital innovation, education, and governance to manage family wealth across multiple generations. What began as private structures for single wealthy families has now become a global sector where many family offices explore new ways to balance efficiency with resilience. The future lies in offices that not only preserve assets but also prepare families to lead responsibly.

Digital Transformation

Technology is no longer optional. Data-driven reporting, ERP platforms, and automation will reshape how family offices offer oversight and control. From portfolio monitoring to compliance dashboards, digital systems create transparency and reduce the risk of reporting gaps. Offices that adopt these tools will gain scale without losing governance discipline. Future-ready family offices will increasingly combine digital tools with governance frameworks to avoid the risks many family offices face today.

Education and Financial Literacy

Balancing Wealth and Personal Affairs

Family offices increasingly integrate financial oversight with personal support. Alongside investment planning and risk management, they coordinate concierge services, bill pay, and personal affairs management. This holistic approach reflects the reality that managing family wealth means managing both the balance sheet and the lived experience of the household.

Building Resilient Structures

- Clear processes to avoid losses from fragmented oversight.

- Strong governance frameworks to manage family dynamics and potential disputes.

- Defined roles for advisors and systems that support effective risk management.

- Continuity plans that ensure succession planning aligns with the family’s assets and legacy goals.