Read Time2 Mins

If we go back in time to evaluate the functions of banks and financial institutions, it would be very different from what you see today. Banks were simply intended to be custodians of client money by facilitating deposits and lending. Their income was the spread between deposit rates and interest charged on loans. How times have changed! Financial firms are now mega-institutions where such interest income spreads have become only a minuscule part of their total revenue – instead the focus has shifted to earning fees from trading, investment advisory, investment banking, proprietary investing, etc. Needless to say, this has resulted in a mindset change at banks leading to riskier and more questionable business practices.

We have seen the ill effects of such risks unfold repeatedly from the early day scams of Charles Ponzi in the 1920s and Stratton Oakmont in the late 1980s to the 2008 crash and collapse of the world’s oldest and strongest financial institutions like Lehman Brothers and Bear Stearns. More recently, Wells Fargo saw another scam after its employees supposedly created millions of fake bank accounts for customers without their knowledge. Even this month, a new scam has hit the British bank – Lloyds, with fake letters being sent out by fraudsters asking for account details.

Customers are becoming increasingly worried about whether their money is really safe in the ‘expert hands’ of their bank. Their concerns are justified as these large financial institutions are often a hot bed for “white collar corruption”. The co-mingling of conflicting businesses within these institutions makes banking professionals often cross the line for personal gain. Compensation structures don’t align customer interests with those of banking professionals. Most disclaimers are written in fine-print, often times only meant to safe-guard banks and their employees. Moreover, regulators are not geared to effectively monitor the complex operations and services of today’s powerful financial institutions.

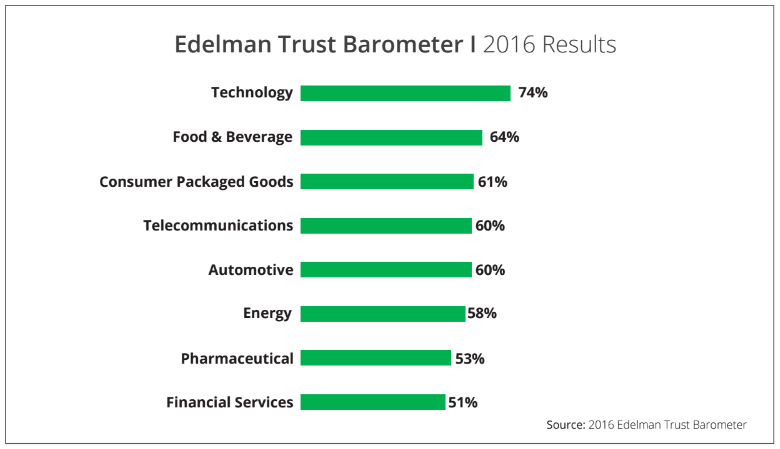

According to the 2016 Edelman Trust Barometer, public trust in the financial services sector ranked last in the 25-country survey of the general population. Only 51% people believed that financial services would do what was morally right all the time.

So in this current climate when it comes to your money, depending entirely on a financial institution’s recommendations can prove to be less than ideal or even harmful. Perhaps, we are coming back full circle – increasingly, customers will start using banks only as custodians and execution platforms and rely on “trusted” specialists for advice and consultation.

In such scenarios, it is imperative to consolidate and own your financial data on a private and fully secure server that only you control and have access to. Powerful analytics on demand, unbiased insights and updated books of accounts on a single platform, helps you keep your eye on the ball anytime, anywhere. Know where you stand and mitigate the chances of you being taken advantage of! While, you can’t avoid the financial institutions, you need an insurance policy that gives you early warnings and keeps you safeguarded.

Leverage technology to get to the bottom-line of what really matters most and stay in control of your financial life with Asset Vantage.