Gain One Unified View of Wealth

with Financial Data Aggregation

and push accurate data across ledgers, dashboards, and reports in real time.

Why Private Equity Reporting Breaks Down

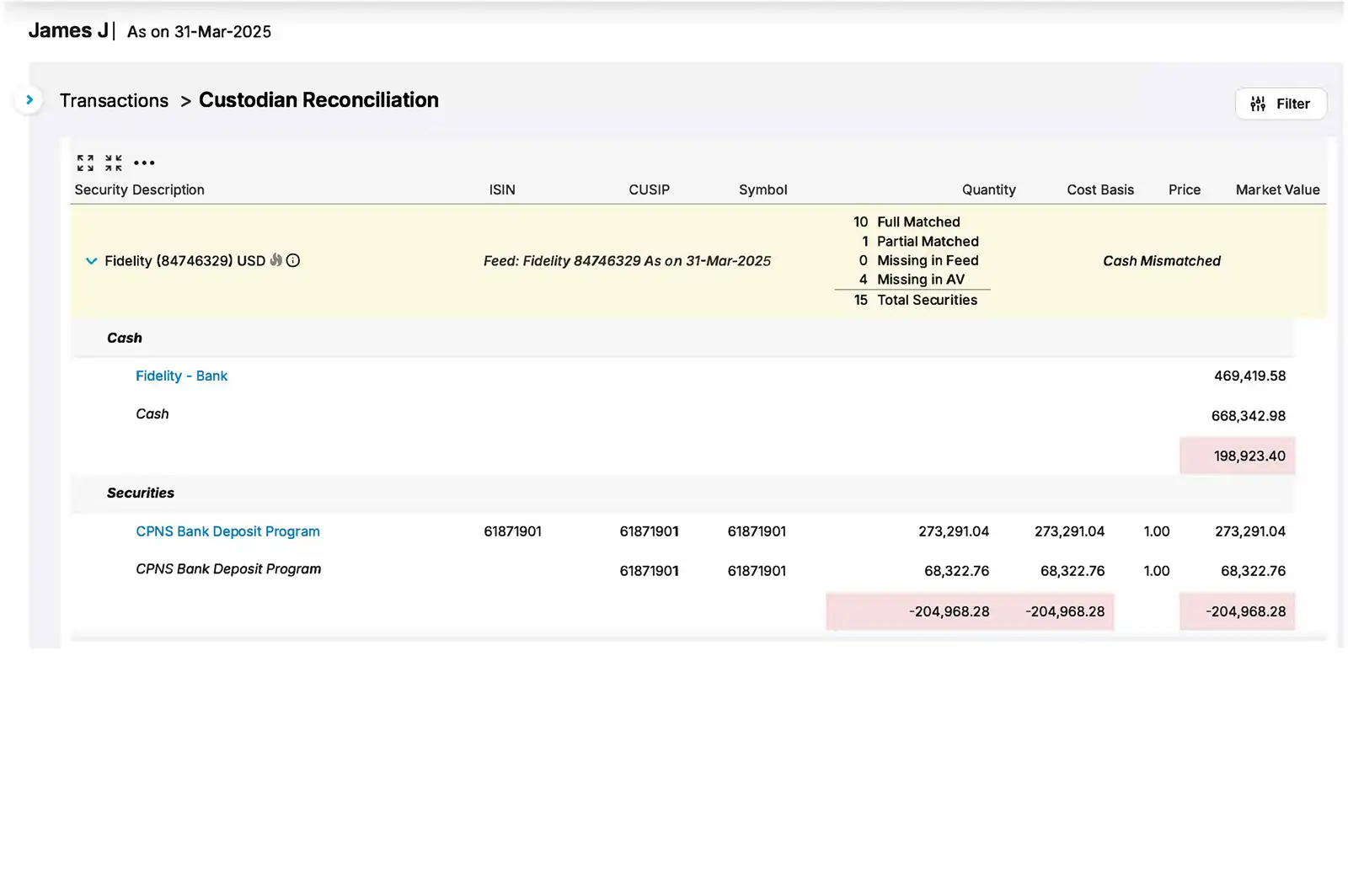

Unified Data Feeds Sync transactions from custodians, banks, and advisors directly into the general ledger.

Critical information arrives months late, slowing

visibility and decision-making.

Non-standardized statements make extracting

commitments, calls, and valuations error-prone.

Manual reconciliations consume hours, with high

risk of missed details or inaccuracies.

Inconsistent record-keeping can result in

inaccurate performance reporting.

Turn Private Equity Complexity

into Clarity with AV

AV’s platform automates accounting and performance reporting for Private Equity and Alternative Assets. It connects with third-party

APIs, supports simple Excel uploads, and lets you adjust past transactions seamlessly. All of this works within the complex

ownership and beneficiary structures typical of family offices

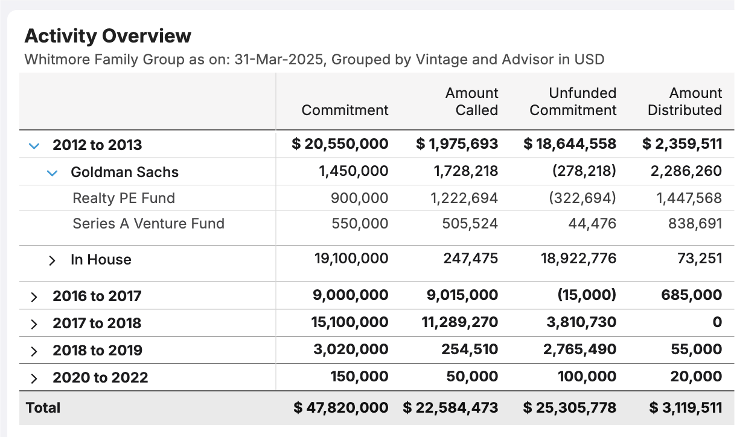

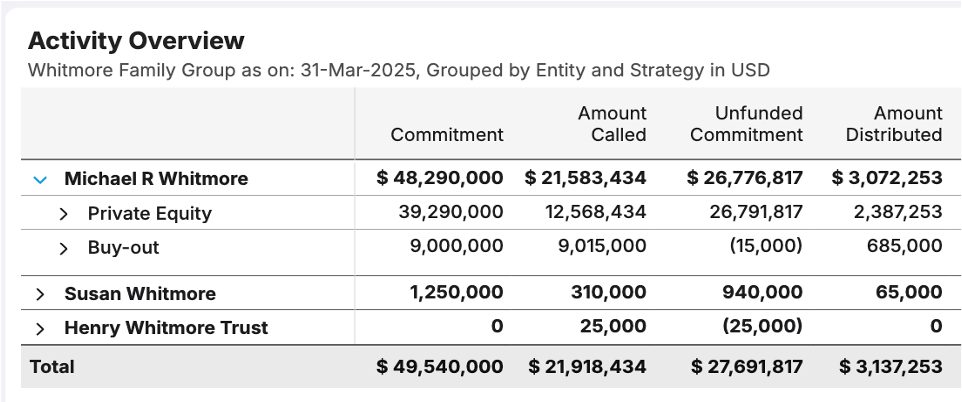

Commitments & Capital Calls

Track unfunded commitments, capital calls, distributions, fees, income & expenses and multiples across vintages

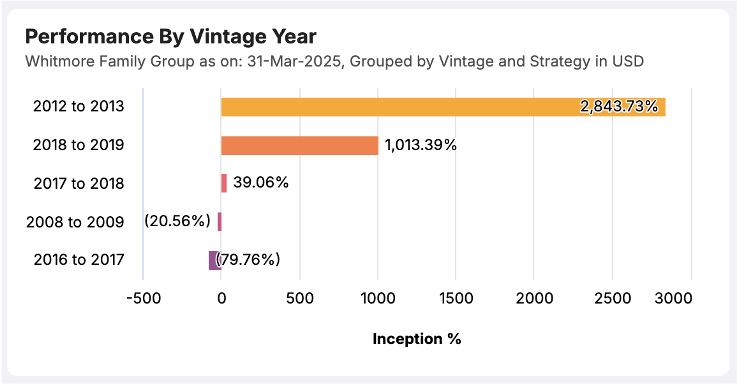

Vintage Analysis

Evaluate fund performance by vintage year using industry-standard multiples like DVPI and TVPI.

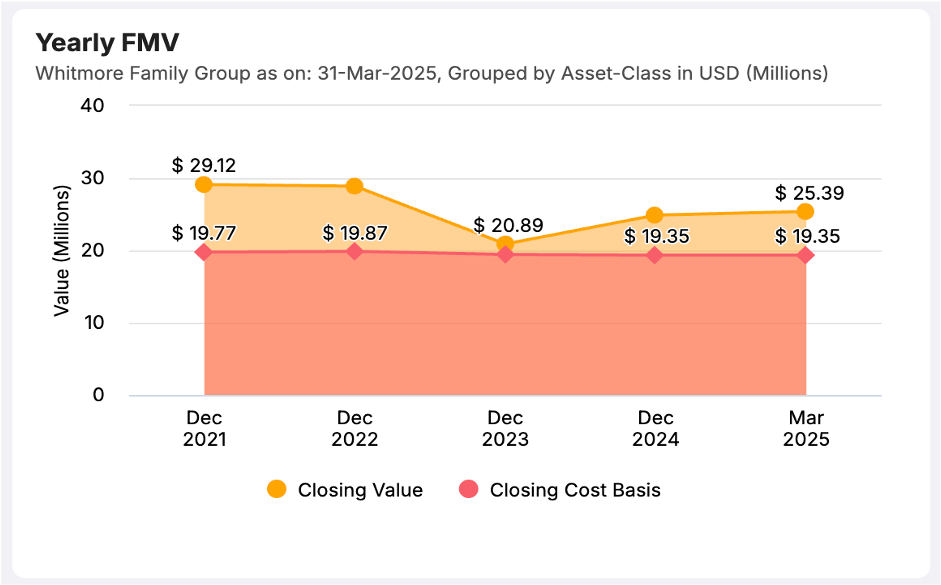

Valuations

Record quarterly or monthly valuation updates to see true performance across funds, sectors, and strategies.

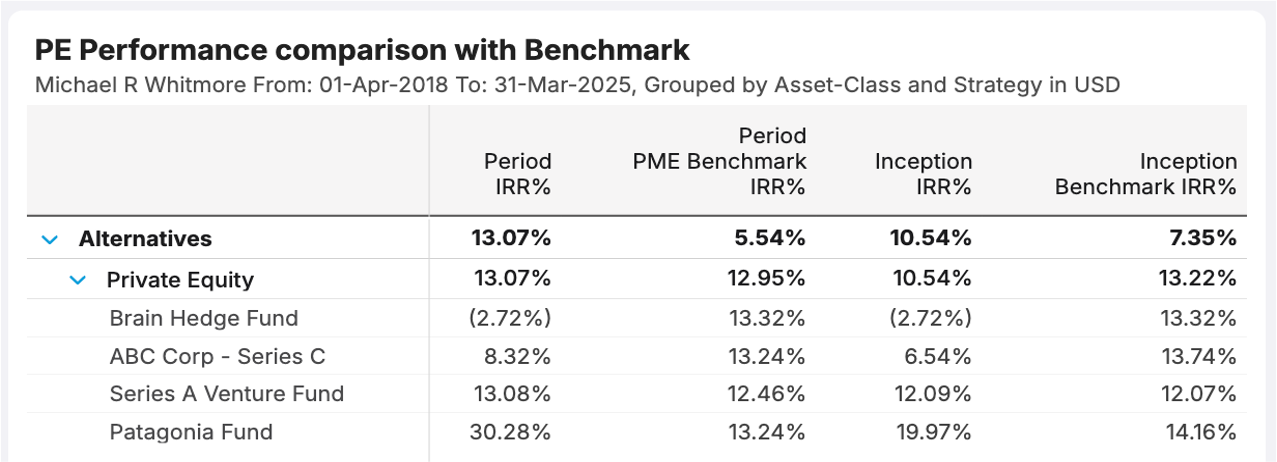

Benchmark Analysis

Compare fund IRRs against Public Market Equivalent (PME) benchmarks for sharper decision-making.

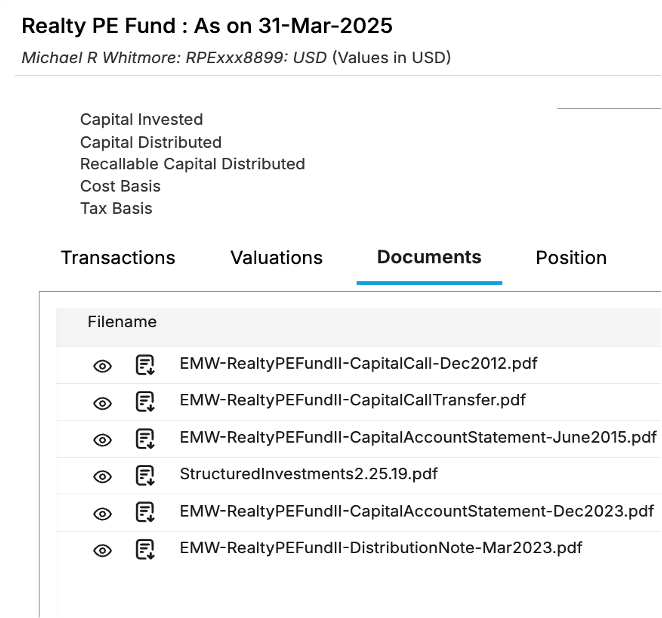

Documents

Attach quarterly reports and statements directly to transactions for seamless audit readiness and quick retrieval.

Bespoke Reporting

Use advanced tagging to treat real estate or venture investments like PE for consistent analysis.

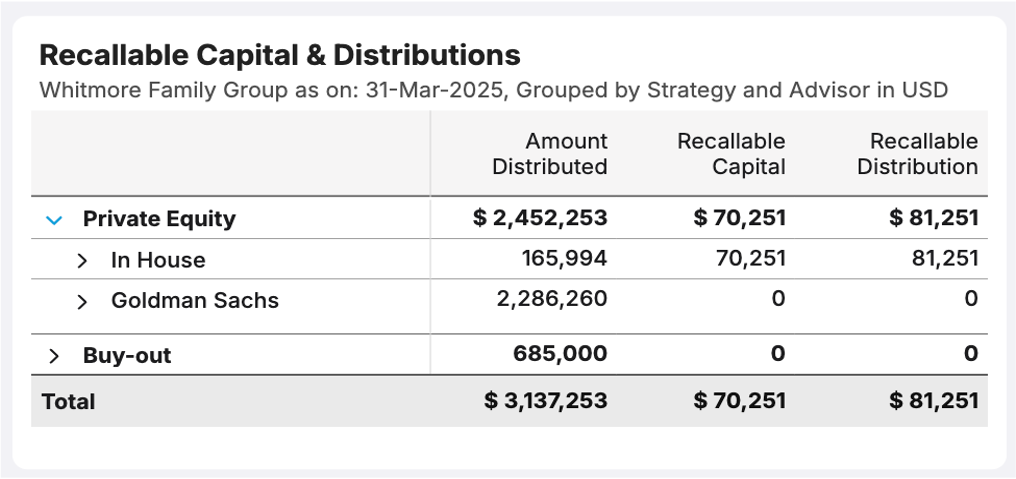

Recallable Capital

Recallable Capital - Track recallable distributions and redeployment with accuracy, eliminating blind spots in fund accounting.

Integrations

Ingest data not just via Excel but also through third-party integrations like Arch for automated aggregation.

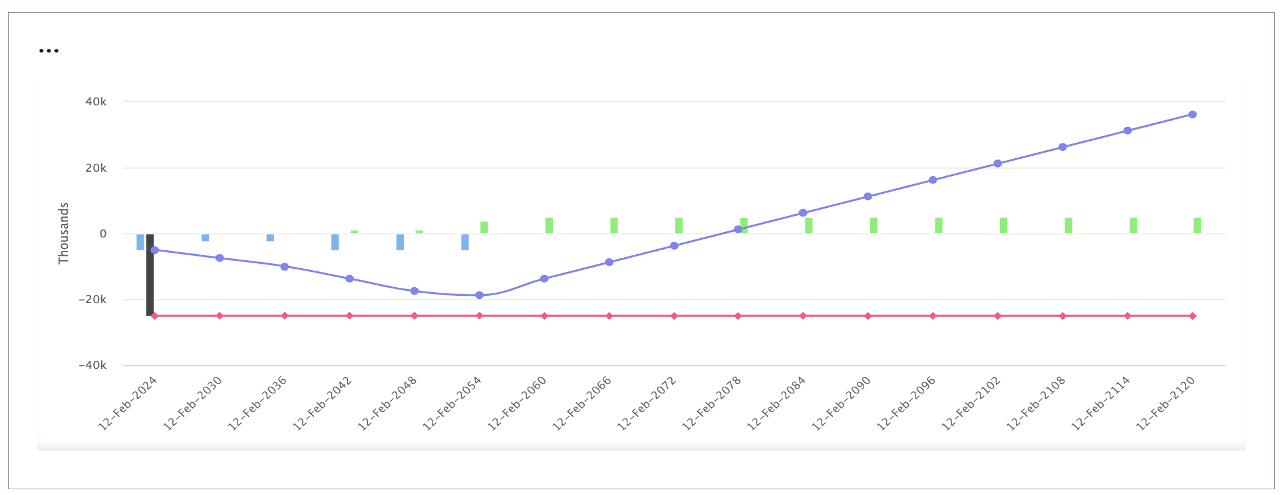

Cash Flow Forecasting

Forecast inflows and outflows with J-curve analysis, integrating unfunded commitments into forward-looking cash projections.

Measure Private Equity with Confidence

Asset Vantage’s benchmark analysis, vintage tracking, and multiples reporting standardize private equity practices within the

platform, turning opaque valuations into clear, comparable insights that drive confident investment decisions.

Bring Precision to Private Equity Decisions

illiquid investments into clear, actionable insights.