- Passwords should consist of a minimum of EIGHT characters to a maximum of THIRTY characters.

- Password complexity should be a combination of alphanumerical, at least one upper case, at least one lower case character, and at least one special character.

- Password should contain at least one numerical value (e.g. 0-9)

- Password should contain at least one each of upper and lower case characters (e.g., az, A-Z)

- Password should contain at least one special character (e.g. !@#$%^&*()+=)

- The system should not allow reusing the last 3 passwords.

- The system should not allow using the user’s first and or last name used in the system.

- The system should not allow using a username, email id, or phone no. used in the system.

- Password should not be allowed to contain a sequence of repeated characters e.g. aaa123 is an invalid password

Institutional Investors

Trusted by over 300+ Institutional Investors globally.

With Asset Vantage, institutional investors see the

TOTAL PORTFOLIO

World-class Performance Reporting

Rich in functionality, our intuitive interface brings clarity to complex portfolios and speed to crucial decisions. Configurable and flexible, our reporting suits what institutions need.

Trusted by

of Global Families

Serving Customers Across

Countries

sample

Assets on Platform

sample

Accounts Aggregated

sample

Custodian & Bank Feeds Integrated

Multi-asset class system

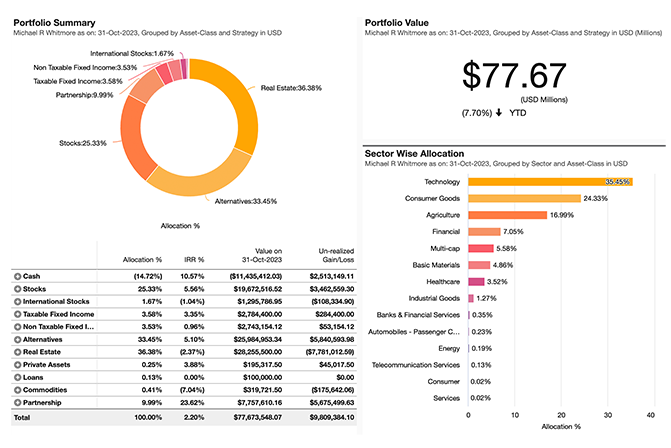

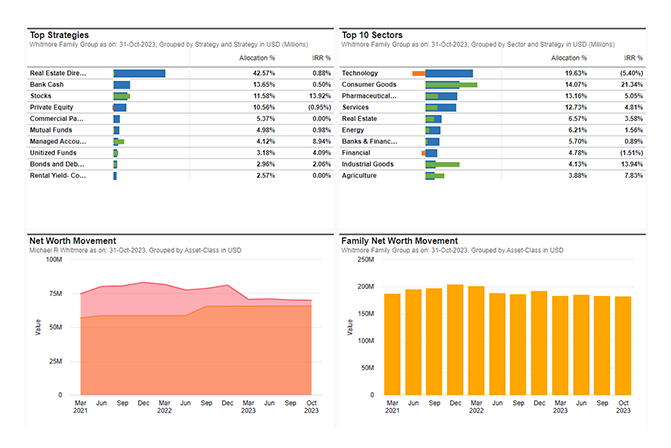

Whether you are making individual investment decisions, outsourcing investments to a third-party manager, or a combination of both, AV’s multi family office software allows you to aggregate data and plug in data feeds, enabling you to report and analyze the consolidated information across asset classes.

Our private equity reporting feature facilitates slicing and dicing of investment data, at the holding, account or manager level, and helps generates reports that enable you to analyze investment data at multiple levels for your U-HNW clients.

AV has predefined and user-defined fields to enable you to generate reports the way you want to report to your U-HNW families.

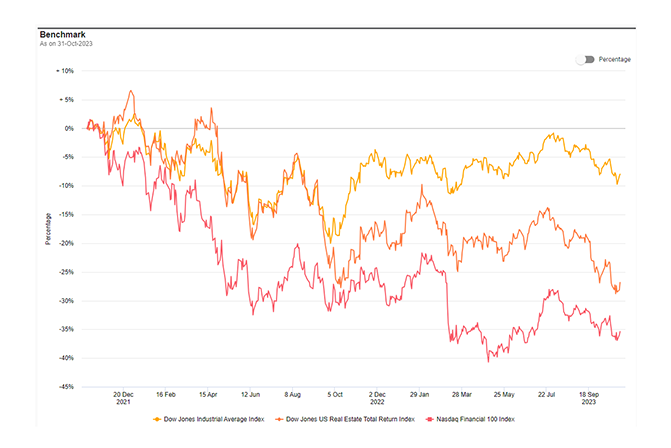

Compare performance with benchmarks

Calculating ROI and tracking investment performance is crucial for the Multi-Family Office professional. As investor demands grow, they want their financial professionals to answer questions about investment performance, risk and benchmark comparisons. Our multi asset class reporting features provide all of these answers and more, directly from the detailed general ledger activity.

AV benchmark supports

- TWR comparison with various indexes

- Public Market Equivalent or PME Benchmarks

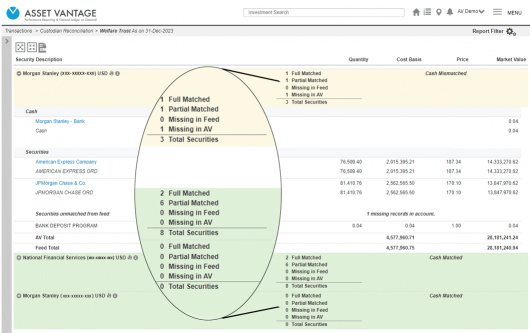

Direct custodian and bank feeds

Stop managing your clients’ financial life with multiple online tools and stodgy spreadsheets.

Simplify your operations with smart upload and data sync features for banking and credit card transactions. Reduce manual effort; use automated data feeds for custodian accounts.

Our direct feed engine interfaces with global partners such as PCR and Electra for custodian transactions, positions and cash feeds and provides easy to use custodian account reconciliation.

Powerful performance reporting

Highly configurable reporting consolidated across investment parameters:

- Asset class

- Strategy

- Advisor

- Accounts

- Geography

- Liquidity & more..

Examples include:

- Summary and detailed reporting of all investment positions.

- Investment performance and comparison against industry benchmarks.

- Analysis of asset allocation across all investments.

- Consolidation of multiple entities for a complete financial picture.

- Generation of custom reports based on individual client needs.

- As on date & multi-period performance with IRR’s for illiquid investments & TWR’s for liquid investments.

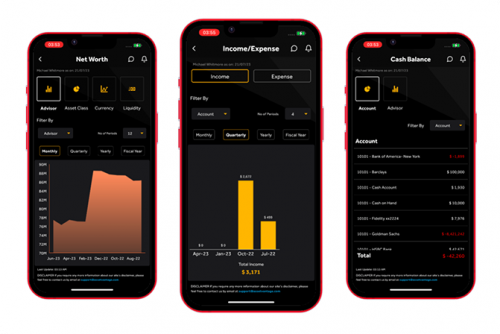

Mobile App featuring dashboard notification and documents for your clients

With an intuitive mobile app dashboard available on IOS and Android platforms, your clients can access their entire financial portfolio on the move. With market data feeds built into AV your clients always have access to current, consolidated information without any additional effort on your part.

Build a superior wealth practice?

Increase Productivity

Accounting firms can now provide a consolidated view across multiple entities on a single platform covering both liquid and illiquid asset classes. Further, accounting firms can access fully automated GL investment accounts and provide institutional grade investment performance reports.

Higher Growth

Accounting firms can minimize their manual work, as AV’s family office accounting software provides data aggregation and reconciliation services. In addition, our Data Management Services can allow accounting firms tackle busy periods and free bandwidth at critical times for more urgent matters.

More Value Addition

Accounting firms can build deeper relationships with their clients by offering them integrated Partnership Accounting along with Look – Through – Reporting and automated US tax reports and 1099 reporting – all this in a highly secure environment possible through private URLs, controlled access to reports, etc.